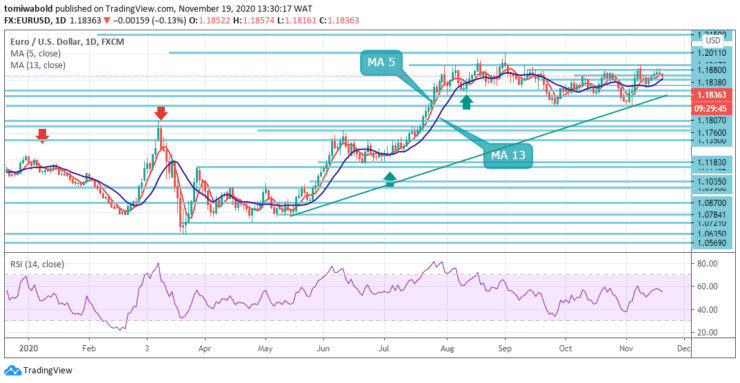

EURUSD Price Analysis – November 19

Following upside rejections, EURUSD broke under and tests the low level at 1.1816 level creating a fresh buying opportunity at 1.1800 to 1.1816 range. The unremitting advance of the pandemic and its impact on the growth prospects of the euro area boost dollar gains on lockdown fears.

Key Levels

Resistance Levels: 1.2011, 1.1917, 1.1880,

Support Levels: 1.1807, 1.1760, 1.1612

As the EURUSD breaks down beneath the MA 5 at 1.1838 level confirms a possible bearish decline to the mid 1.1800 level. However, a bounce from this zone may usher in the retest of the 1.1900 area. A bullish breakout above the resistance at the 1.1838 level could indicate a surprise return of an immediate upside.

In the larger context, an increase from the 1.0635 level is seen as the third phase of the trend from the 1.0339 (low) level. A sustained rally could be seen to cluster resistance at 1.2011 level next. This will remain the favored case as long as the 1.1422 resistance level turned support holds.

Following the rejection from the 1.1917 regions, the corrective downside in EURUSD could extend initially to last week’s lows in the 1.1760 regions ahead of the contention area near the 1.1685 level.

Intraday bias in EURUSD stays in a range as consolidation from the 1.1917 level is still in progress.

On the upside, the breach of 1.1917 level may validate the scenario that consolidation from 1.2011 level has finished at 1.1612 level. A further increase would be seen to retest 1.2011 high level. Meanwhile, a breach of the 1.1725 support level may shift bias to the downside to extend the range with another declining phase.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.