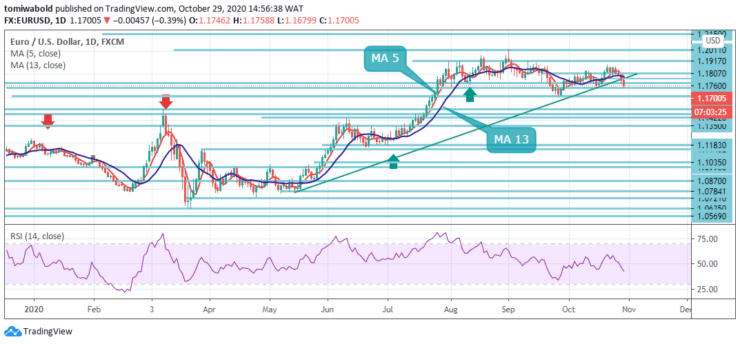

EURUSD Price Analysis – October 29

The single currency EURO came under pressure towards the 1.1685 level on a fresh wave of risk aversion. EURUSD sheds ground for the fourth consecutive session and managed to stabilize above the 1.1695 level after falling on Thursday amid the ECB monetary policy meeting.

Key levels

Resistance Levels: 1.2011, 1.1917, 1.1807

Support Levels: 1.1685, 1.1612, 1.1495

EURUSD is losing momentum and retesting the 1.1700 area against the US dollar. Some downside potential may likely prevail in the market, as the exchange rate is under pressure from moving averages 5 and 13 below the ascending trendline support at 1.1725.

In this case, the rate may reach the psychological level of 1.1685.

On the other hand, any meaningful retracement attempt is likely to face tough resistance near the 5 and 13 moving averages in the 1.1790 regions. Some subsequent buys above 1.1807 will negate any short-term bearish trend and bring the pair back to the highs around the 1.1870-1.1917 supply zone.

EURUSD is still holding above the 1.1685 support level after the previous day’s decline. Intraday bias remains neutral for now. However, on the other hand, a solid breakout of the 1.1685 support level should resume the corrective pattern from the 1.2011 level with a new cycle.

The intraday shift will be turned down towards the support level 1.1612. A break would target the 38.2% retracement from 1.0635 to 1.2011 at 1.1495 levels. However, if it rallies above 1.1917, the pair will pull back from 1.1612 to retest the 1.2011 high.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.