EURUSD Price Analysis – August 24

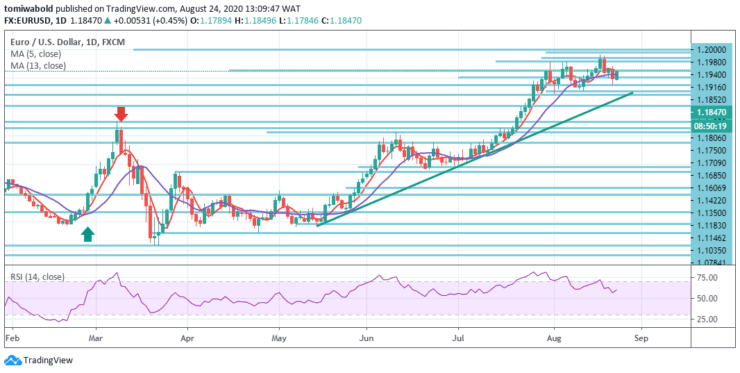

The Euro recovered traction during the European session on Monday after the decline of 0.5 percent on Friday, but there is still a risk of a deeper pullback. The multi-month high pullback at 1.1965 level meets buyers at 1.1754 level, and the continuing extension past 1.1800 level today, triggers immediate positive signals.

Key Levels

Resistance Levels: 1.1980, 1.1940, 1.1916

Support Levels: 1.1806, 1.1709, 1.1685

EURUSD holds beneath the moving average of 5 and the pressure stays downwards. Besides, on Friday the pair set a lower high implying the anticipated downtrend. Support awaits at level 1.1750, Friday’s low, followed by level 1.1709, a double-bottom from earlier this month.

Its resistance awaits at a level of 1.1852 level, a low swing from last week, followed by a level of 1.1916. But the positive outlook on the daily chart is further improved by bullish technical indicators. Therefore, any follow-through intensity towards horizontal resistance at level 1.1852 now seems like a strong likelihood amid some initial selling across the greenback.

At the moment, the intraday bias in EURUSD holds steady. So long as the 1.1709 support level remains, the further increase may continue slightly in support. A breach of level 1.1965 may prolong the entire increase from level 1.0635.

Nonetheless, given the state of bearish divergence in 4 hrs RSI, a breach of 1.1709 level may validate short-term topping. With the ascending trendline (now at level 1.1685) the intraday bias is shifted back to the downside.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.