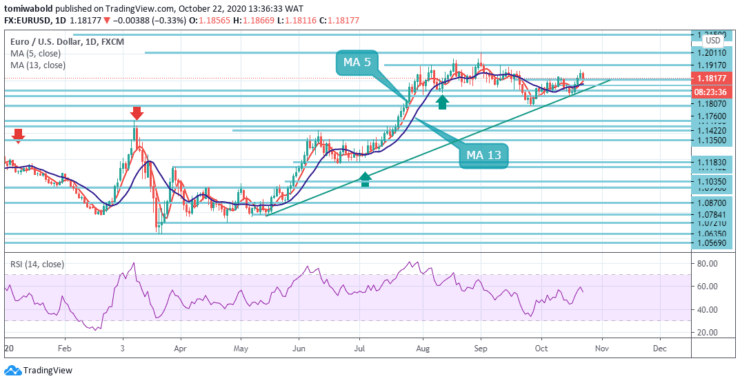

EURUSD Price Analysis – October 22

The EURUSD pair exited overbought conditions and is ready to rally while correction sets in towards the 1.1807 regions. EURUSD has been keeping onto earnings arising from stimulus anticipation but foreign meddling in the US elections and increasing COVID-19 incidents may confine any earning.

Key Levels

Resistance Levels: 1.2150, 1.2011, 1.1917

Support Levels: 1.1807, 1.1612, 1.1422

The corrective downturn carries the potential for expansion to the 13 moving average, which is today at 1.1766, which is expected to initially contain the bearish move. In the broader scenario, the bullish outlook on EURUSD is expected to remain unchanged as long as the pair trades above the critical support of the ascending trend line, today at 1.1725.

In a broader context, the rise from 1.0635 is seen as the third phase of the trend from 1.0339 (low). Further, we should expect further growth to the cluster resistance at 1.2011. This will remain a preferable case as long as the 1.1422 resistance turned into support is held. Another visit to the 2020 high beyond the critical level of 1.20 is not welcome shortly.

The intraday slope of EURUSD remains downward for now. Although the rebound from 1.1612 is still ongoing to retest the 1.2011 high. However, a strong break there will resume a stronger rally from the 1.0635 level. On the other hand, below 1.1807, minor support will initially make a neutral intraday bias.

The Relative Strength Index on the 4-hour chart fell below 70 values, emerging from an overbought condition. Key support is at 1.1760 low, followed by 1.1725, a step on the way up. The next levels to pay attention to are 1.1685 and 1.1612. Reaction along the support for the breakout will determine whether the move can be trusted.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.