EURUSD Price Analysis – October 15

The euro currency trends beneath the 1.1725 level against the US dollar, with buyers of EURUSD losing strength. The pair is trading lower at the level of 1.1705 at press time. As the US-German bond yield differentials are growing amid concerns of a lengthy coronavirus-induced recession across the Eurozone, the risks to EURUSD seem skewed to the downside.

Key Levels

Resistance Levels: 1.2011, 1.1917, 1.1807

Support Levels: 1.1612, 1.1422, 1.1350

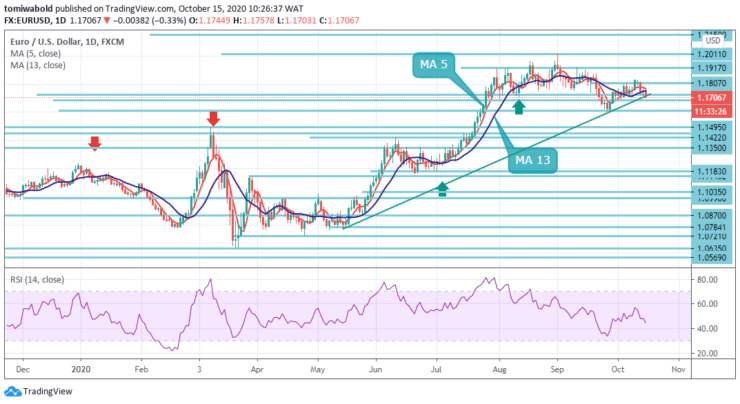

On the daily chart, from a technical point of view, the downward slide has the potential to push the pair beneath the recent swing lows support, around the 1.1685-12 region. On the contrary, an initial resistance is projected near the 1.1807 regions.

In the wider sense, rising from the level of 1.0635 is seen as the third stage of the trend from the level of 1.0339 (low). For cluster resistance at 1.2150 level next, (38.2 percent retracement of 1.6039 to 1.0339 at 1.2150 levels), the additional rally might be seen. This might remain the preferred case as long as the level of resistance converted to 1.1422 support holds.

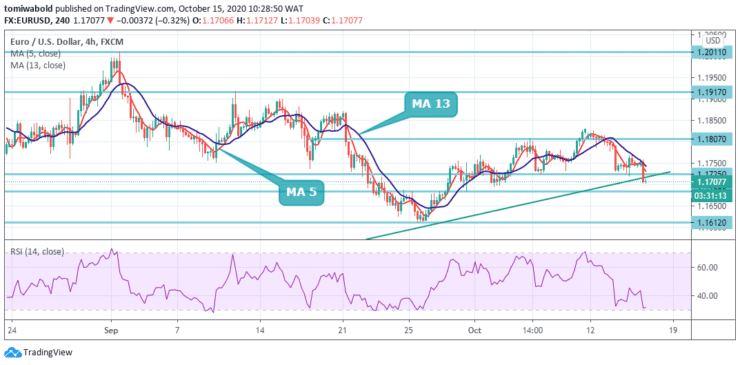

At this point, intraday bias holds firm in EURUSD. On the upside, the 1.1807 level breach may continue the rebound from the 1.1612 level to the 1.2011 high-level re-test. On the downside, though, the 1.1725 level breach implies that the 1.2011 level correction is expanding with another step. For the 1.1612 level and below, intraday bias may get turned back to the downside.

In other words, the EUR may, for a while exchange between the two major levels of 1.1685 and 1.1807. That being said, there has been a rise in shorter-term downward momentum and a test of 1.1685 level may not be unexpected.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.