EURUSD Price Analysis – February 16

The EURUSD pair continues to trade in multi-day highs and targets the 1.2200 marks during the mid-week. The single currency rises higher and propels the EURUSD in an attempt to run past prior highs. The recently released Eurozone data was upgraded to 0.6% in Q4 while the German ZEW Economic Sentiment beat estimates.

Key Levels

Resistance Levels: 1.2240, 1.2222, 1.2190

Support Levels: 1.2081, 1.2011, 1.1952

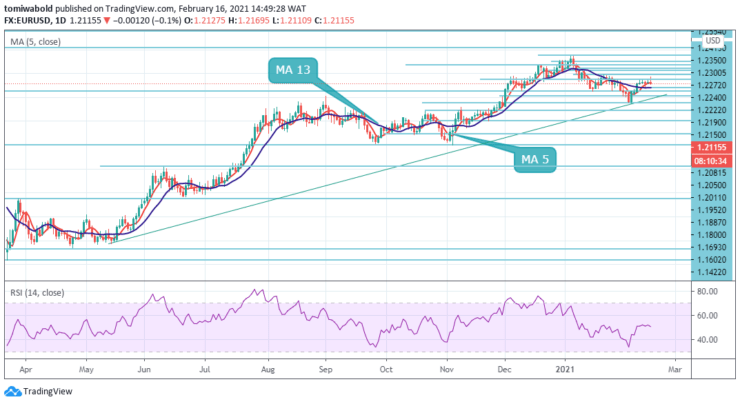

As seen on the daily chart, the EURUSD lifts higher from the 1.2125 level supported by the MA 5 and it’s likely the exchange rate gains support below at the MA 13 at 1.2088 in the event of a pullback. On the broader picture, the constructive stance in EURUSD stays unaltered while above the critical horizontal level, today at 1.2150.

However, the EURUSD still confronts a tough barrier in the 1.2200 zones ahead of the current price. The rebound from 2021 lows near 1.1952 (Feb. 5) follows the constructive outlook for the pair in the longer run. On the downside, the next support lines are up at 1.2011 followed by 1.1952, and finally 1.1887 low.

EURUSD has been struggling to pull out of the MA 5 and 13 regions on the four-hour chart and trades above at 1.2040. The Relative Strength Index is below 60, thus outside overbought conditions and allowing for further gains.

The pair’s next resistance awaits at 1.2190 level, which has capped its price, although more further move beyond the 1.2190 and 1.2222 levels is eyed. Some support is at the low of 1.2118, followed by 1.2081 levels, a swing low from last week. A more significant cushion is at the 1.2050 level.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.