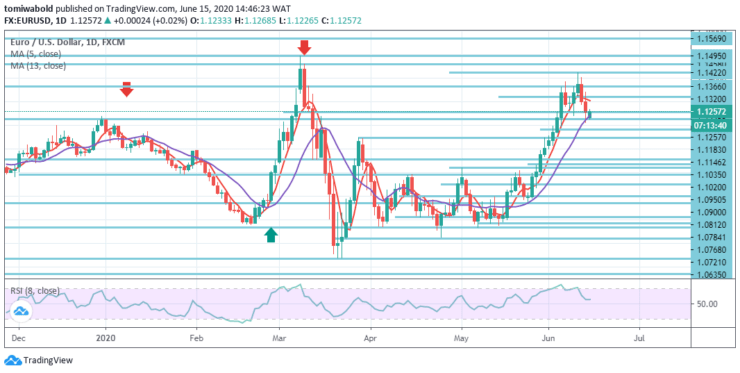

EURUSD Price Analysis – June 15

EURUSD is looking to stabilize above the 1.1226 marks against the backdrop of the recent move lower from monthly tops beyond the 1.1400 level. The pair has maintained a positive tone amid the earlier anticipated weakness towards the level at 1.1226. The growing sense of normality in Europe is insufficient against the safe-haven dollar. After holding up against the mighty greenback, the EURO is beginning to crack lower.

Key levels

Resistance Levels: 1.1495, 1.1422, 1.1320

Support Levels: 1.1226, 1.1055, 1.0635

EURUSD ‘s weakness now stretches to its moving average of 13 at about 1.1226 level. Though it maintains for now as the initial risk is considered lower, and beneath the level of 1.1226 may posit that the drawback may also increase more into support visible next at the level of 1.1183, more notably at the level of 1.1122, the 38.2 percent retracement of the whole rally from March.

Resistance is initially seen at a level of 1.1320 until a level of 1.1366. Beyond it’s important to say that the reversal is now over and the rally may start with resistance then seen at level 1.1422 ahead of level 1.1458, then the high level of 1.1495 for the year. Although this latter level must be explicitly acknowledged, a breach may register a medium to the long-term floor. EURUSD Short term Trend: Bullish

EURUSD Short term Trend: Bullish

At this phase, the intraday bias in EURUSD stays on the downside. The decline from the short-term top level of 1.1422 may attempt a retraction of 38.2 percent from 1.0635 to 1.1422 at 1.1121 levels. Where the continuous breach may imply a total rebound from 1.0635 level has been reached and a further decline at 1.0936 levels to 61.8 percent retraction.

Nonetheless, on the upside, breach of 1.1230 minor level of resistance may instead alter bias back to the upside at 1.1422 level. Once the preset resistance maintains, a southern reversal may arise, and the currency pair may aim the level of 1.1200.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.