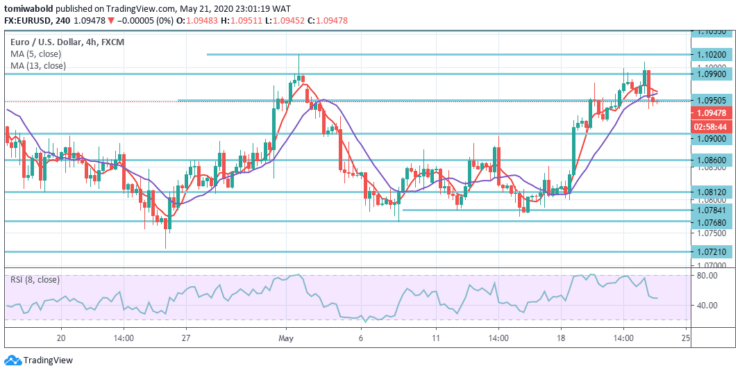

EURUSD Price Analysis – May 21

During Thursday’s American session, the EURUSD pair tested the 1.10 threshold upside down and was seen 0.20 percent lower on the day. The FX pair extends the recovery and flirts past the level of 1.1000 towards the main barrier potential test in the region of 1.1055 and later lost momentum. PMIs in the Eurozone have, for the most part, surpassed anticipations and yet stay depressed.

Key Levels

Resistance Levels: 1.1495, 1.1146, 1.1055

Support Levels: 1.0900, 1.0784, 1.0635

EURUSD ran out of steam on the daily chart after reaching the level at 1.1008. The daily bias shifts to the downside. The long term outlook is nevertheless unchanged as the corrective trend from level 1.0635 continues.

A further decrease could be seen from the resistance level 1.0990 beneath level 1.0950. Yet in that scenario, a retracement of 61.8 percent from 1.1495 to 1.0635 at 1.1236 levels may restrict the upside. On the downside, a breach of 1.0784 level may transform bias back to the downside for low level 1.0635 retesting.

The EURUSD pair already is breaking the 1.0950 key support level which is a crucial handle. Consequently, the level of critical resistance above at the horizontal line is located around the 1.0990 level just pips 40 pips beyond this threshold.

Thereby, traders may be selling underneath level 1.0950 with the stop-loss of around level 1.0990. Furthermore, so unless the pair leaps past the level of 1.0990, these stop-losses might be reached, which may drive the pair much further, reaching 1.1020 level in the initial response.

Note: learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.