EURUSD Price Analysis – April 16

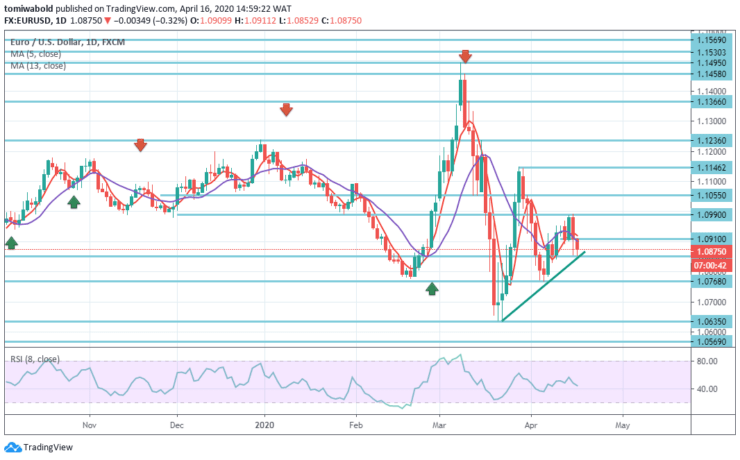

This Thursday, the EURUSD pair slid to 1.0852 level, then upwards toward the price zone of 1.0910 level due to the release of crucial US data. The mood of the market remains mixed amid the strength of the USD, depending on the possibility of economic re-opening. However, the economic deadlock end remains uncertain.

Key Levels

Resistance Levels: 1.1495, 1.1146, 1.0990

Support Levels: 1.0768, 1.0635, 1.0569

EURUSD Long term Trend: Ranging

The upside momentum on the EURUSD daily chart has run out of steam near the main barrier around 1.0990 level, triggering the unfolding downside of the reversal shortly after. The moving average of 13 may drive the exchange rate further down to 1.0890 level. Remember that the closest daily support level is S1, placed at the level of 1.0852.

Furthermore, if the currency pair fails to breach the 1.0852 marks, the euro is inclined to stabilize in the medium to long term against the US Dollar. It is also probable that bulls may dominate in the market, and the pair may surpass the 5 moving averages close to 1.0920 level.

EURUSD Short term Trend: Ranging

The EURUSD pair is trading near 1.0878 level, the retracement of its daily advance by 50 percent of late March, unable to break the mark. The uncertainty remains weighted to the downside in the 4-hour chart, as the pair evolves beneath both moving averages, while the technical indicators remain at negative levels, with moderate declining slopes.

The key support is the retracement of the same recovery by 61.8 percent at 1.0852 level, with a stiffer fall forecast on a break beneath the level. A bear market may begin as soon as the pair declines beneath a support level of 1.0852, triggered by a downward movement to support a level of 1.0768.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.