EURUSD Price Analysis – July 2

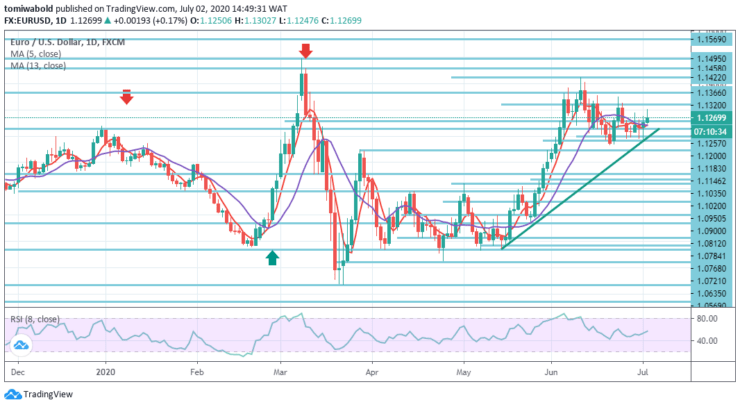

Since another fall into the region of 1.1183, EURUSD has restored buying interest and has now traded at 1.13 figures past the main barrier. The Euro grew overnight, powered by renewed risk-on sentiment following strong revision of data from ADP employment, stronger than anticipated from US manufacturing PMI and revived potential Covid-19 vaccine optimism.

Key Levels

Resistance Levels: 1.1495, 1.1422, 1.1366

Support Levels: 1.1183, 1.0950, 1.0635

As seen on the daily, fresh intensity emerged beyond both moving averages 5 and 13 (at level 1.1240) which limited the activity in the past five days and attempts to emerge past the congestion at level 1.1257. Indicators of momentum are trying to turn back higher as the price is continuing to advance and, more significantly, the daily RSI continues to stay beyond 50.

In the wider context, the whole downtrend from 1.2555 (high) level may still be in progress as long as 1.1495 resistance level stays. The upcoming goal is level 1.0339 (low). Nonetheless, a continuous breach of the 1.1495 level may suggest that such a downward trend is over. In this scenario, the perspective is altered bullish for a 1.2555 level retest.

Given the uncertainty this week, EURUSD is still confined in range. Bias in intraday stays optimistic, and the trend remains consistent. On the downside, the 1.1183 level breach may aim a retraction of 38.2 per ent from 1.0635 to 1.1422 at 1.1145 levels.

The continuous breach there may claim that a full recovery from 1.0635 level has been achieved, taking a lower fall to a retraction of 61.8 percent at 1.0950. On the positive, the 1.1366 level breach is probably to restart the increase from 1.0635 through 1.1422 to 1.1495 main resistance levels.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.