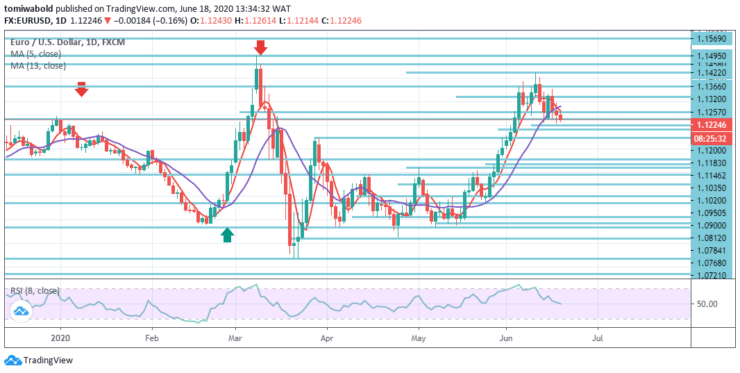

EURUSD Price Analysis – June 18

EURUSD has been edging down, trading beneath the level of 1.1257, with US coronavirus concerns outweighing growing numbers. The FX pair broadens the consolidation pattern in the mid part of the week beyond the level of 1.12, thus far.

Key Levels

Resistance Levels: 1.1495, 1.1422, 1.1320

Support Levels: 1.1200, 1.0950, 1.0635

In the wider context, the entire downtrend from 1.2555 (high) level may still be in effect as long as 1.1495 resistance level holds. The next aim is level 1.0339 (low). Nevertheless, a continuous breach of the 1.1495 level may suggest that such a downward trend is over.

Then, the increase from level 1.0635 may be seen as a third phase of the trend from level 1.0339. In this scenario, the trend is altered bullish for a 1.2555 level retest.

Intraday bias in EURUSD stays neutral first. On the upside, a break of 1.1422 level will resume the whole rebound from 1.0635 level and target 1.1495 key resistance level next.

On the downside, a break of 1.1226 level will resume the fall from 1.1422 level to 38.2% retracement of 1.0635 to 1.1422 at 1.1146 levels. The sustained break there will argue that the whole rebound from 1.0635 level has completed and brought a deeper fall to 61.8% retracement at 1.0950 level.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.