EURUSD Price Analysis – May 7

The US dollar stayed in demand for the fourth day in a row and continued to exert downward pressure on the EURUSD pair. The FX spot trades horizontally beneath 1.0800 level at press time. Given the effects of the coronavirus disease outbreak, the European Commission said that in 2020 the GDP of the eurozone will decrease by 7.7 percent.

Key Levels

Resistance Levels: 1.1495, 1.1146, 1.0900

Support Levels: 1.0721, 1.0635, 1.0569

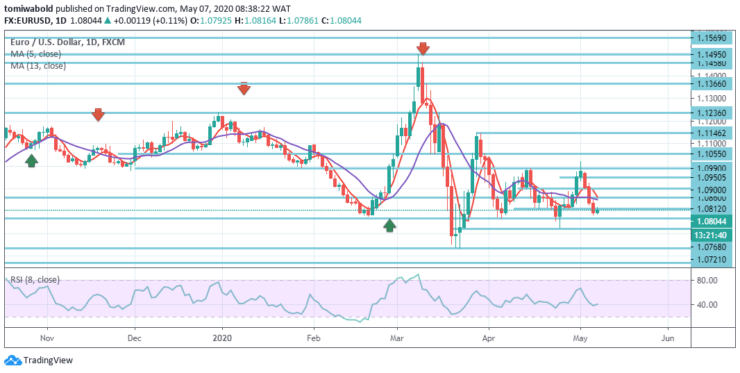

EURUSD Long term Trend: Bearish

EURUSD advances are likely to be capped at 1.0812 level with slight resistance hence a bearish potential at 1.0860 level with restrictions near 1.0900 level. A break beneath 1.0768 level attempts at1.0721 lower level of support near the low of April for some gains on short. The next bearish signal is a split underneath.

Within the wider sense, as long as the resistance level of 1.1495 remains unchanged, the entire downward trend from the level of 1.255 (high) level will still be in effect. The initial goal is level 1.0339 (low) level. Nevertheless, a persistent break of 1.1495 level may suggest that such a downward trend is over.

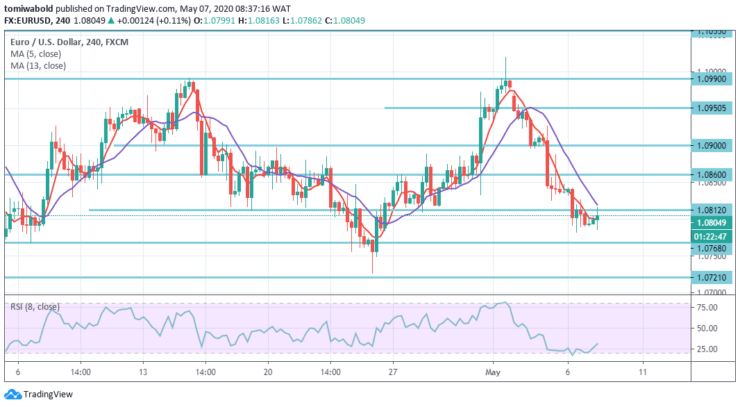

EURUSD Short term Trend: Bearish

Intraday bias in EURUSD remains on the downside towards the support level at 1.0721. A breakdown is to reach a low level of 1.0635. On the upside, the level of resistance beyond 1.0900 minors may first alter neutral intraday bias.

And besides, the corrective trend from the low level of 1.0635 is also ongoing and may continue. However, given a recovery, a 61.8 percent retraction of 1.1495 to 1.0635 at 1.1146 levels may constrain potential upside.

Note: learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.