EURUSD Price Analysis – May 25

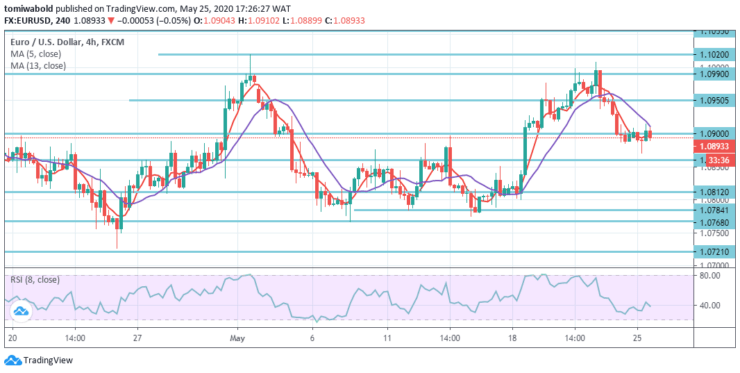

The EURUSD pair failed to create any solid directional bias and swing set through the early North American session on Monday between growth / small losses. The downside stayed shielded close to the level at 1.0860 beneath the level of 1.0900.

Key levels

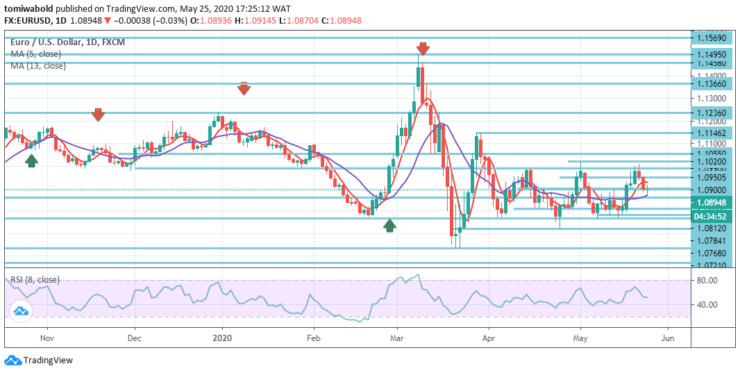

Resistance Levels: 1.1495, 1.1146, 1.1020

Support Levels: 1.0784, 1.0635, 1.0339

In the larger context, the entire downtrend from 1.2555 (high) level may still be in progress as long as 1.1495 resistance level holds. The next target is to level 1.0339 (low). Nevertheless, a continued break of 1.1496 level may assert that such a downward trend is over.

Then, the increase from level 1.0635 may be seen as a third stage of the trend from level 1.0339. In this scenario, the trend may be altered to bullish for a 1.2555 level retest.

EURUSD intraday bias remains neutral, and the trend stays intact. On the contrary, the 1.0784 level breach could aim for a low level of 1.0635 for a retest. On the upside we may see a stronger rebound to 1.1146 resistance level beyond 1.1020 level.

Simply put, the price activity from level 1.0635 is seen as a trend of consolidation. Meanwhile, at 1.1236 level, the upside may be restricted by a 61.8 percent retraction from 1.1495 to 1.0635 levels.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.