EURUSD Price Analysis – July 30

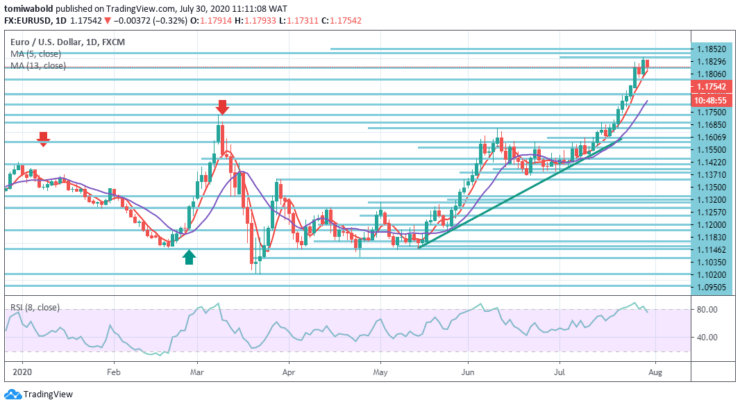

Investors are taking a breather after notching new highs beyond the 1.1800 mark in the prior session, although at the time of this post EURUSD established on a corrective pullback to the mid-1.1700s level. Statements from Fed marginally impacted risk bias and compelled investors to cover some gains after the pair spiked barely beyond 1.1800 level and reached a new nearly two-year peak.

Key Levels

Resistance Levels: 1.1852, 1.1829, 1.1806

Support Levels: 1.1685, 1.1606, 1.1495

The pair is currently losing 0.35 percent at 1.1754 level and confronts initial tension at 1.1495 level, closely followed by level 1.1448 and eventually 1.1422 level (monthly high Jun.10). On the positive side, a 1.1806 high-level breakout may aim at 1.1829 level going north to 1.1852 upside-resistance level.

The stable breach of 1.1495 resistance level now implies, in the wider context, that the entire downtrend from 1.2555 high level has already been achieved at 1.0635 level. The rising level pattern of 1.0635 level should be the third phase of the pattern from level 1.0339 (low). More increase may be seen as this would stay the preferred scenario as long as 1.1183 level of support persists.

As shown in the 4-hour chart, given lack of upside traction, its intraday bias persists slightly on the upside. The steady 100 percent prediction split of 1.0550 to 1.1422 levels from 1.1183 at 1.1829 levels may aim 161.8 percent forecast next at 1.2216 level.

On the contrary, the intraday bias may shift neutral and put consolidations initially beneath the 1.1606 minor support level. But 1.1422 resistance turned support level should contain the downside of retreat and carry a further rally.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.