EURUSD Price Analysis – August 13

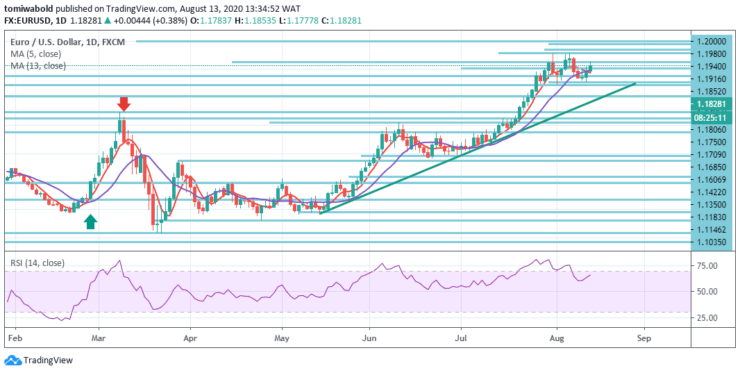

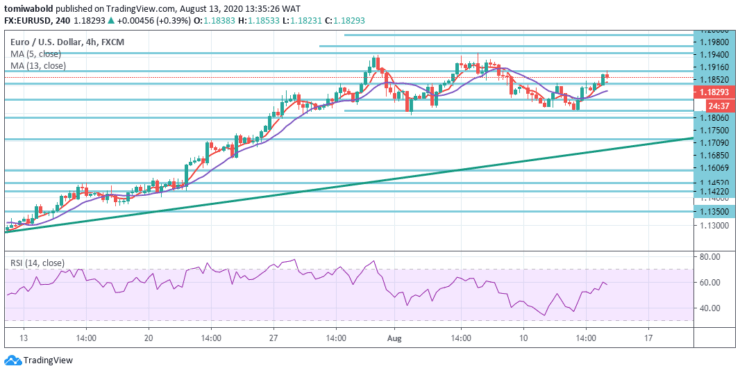

The appearance of some fresh selling around the US dollar supported the EURUSD pair to reverse an initial fall into the mid-1.1700 range. EURUSD is presently hacking away at a psychological barrier of 1.18 plus, setting it at a low level of 1.1777 at the European Session. The US Congress deadlock over additional COVID-19 stimulus package triggered higher-level selling of the US dollar.

Key Levels

Resistance Levels: 1.1980, 1.1909, 1.1852

Support Levels: 1.1750, 1.1709, 1.1685

Despite the selloff from last Thursday’s fresh 2-year high at 1.1916 to 1.1711 levels of yesterday, the ensuing rebound to 1.1817 level of the same day indicates that the first correction process has finished and consolidation with upside bias persists for recovery to 1.1852 level and beyond.

Nevertheless, resistance at level 1.1916 may stay unchanged and ultimately yield retreat. On the downside, just beneath the level of 1.1750 may imply an end to the above-mentioned recovery instead and a potential weakness at 1.1709 level later.

EURUSD rebounds from support level 1.1685 but remains well beneath resistance level 1.1916. First of all, the intraday bias stays neutral. Further rally is in support as long as it holds a support level of 1.1685.

The 1.1916 level breach may resume the entire 1.0635 level increase. The firm breach of 1.1685 near-term support level, nonetheless, may validate short-term topping on the downside. The intraday bias would be reverted to the downside towards ascending trendline support (now at level 1.1606).

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.