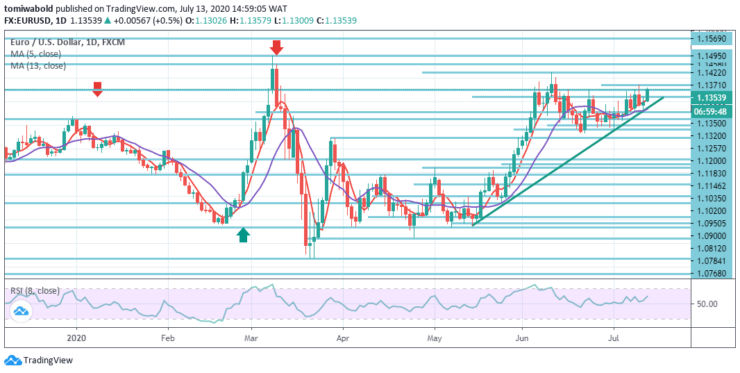

EURUSD Price Analysis – July 13

EURUSD lengthens the recovery from the lows near 1.1257 level of Friday and accumulates ground on Monday around 1.1335/55 band. Fears about the second wave of coronavirus diseases have taken its toll on the global context of risk and driven some haven flows toward the USD.

Key Levels

Resistance Levels: 1.1495, 1.1422, 1.1350

Support Levels: 1.1257, 1.1183, 1.0950

Daily, EURUSD is rising 0.47 percent in trade at a level of 1.1354, as the pair heads to the high of 1.1371 level in July. EURUSD is going back to its latest high level of July at 1.1371, beyond which is the trough of June at 1.1422 level.

This might continue in play as the cross stays past the level of 1.1257 beyond the two-month support line and, more specifically, beyond the low level of 1.1183 July 1. Initial upside pressure should be held past the level of 1.1257 beyond the low of Friday.

At this point, the intraday bias in EURUSD remains stable. On the upside, the high level beyond 1.1371 may reach 1.1422 level. The breach may regain a bigger increase from 1.0635 to 1.1495 main resistance.

On the contrary, though, a breach of 1.1257 lower support level may shift the bias back to the downside, expanding the rebound to a 38.2% retraction of 1.0635 to 1.1422 at 1.1146 levels.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.