Following the publication of a modest inflation report in the United States, as indicated by the Department of Labor’s (DoL) October Consumer Price Index (CPI) data, the euro (EUR) ended last week on a stronger note and could resume on a bullish trajectory this week.

That said, as expectations for a slowing in the Federal Reserve’s (Fed) tightening cycle following the CPI announcement remained high, the US dollar (USD) extended its losses for four straight weeks. As a result, the EUR/USD increased by 1.42% to trade at 1.0352 as the euro continued to rise.

Wall Street saw significant gains for the week. Core CPI, which the Federal Reserve regularly monitors, slipped from 6.6% YoY in September to 6.3% on Thursday, considerably below expectations, according to US inflation data.

According to data released on Friday, the University of Michigan’s (UoM) Consumer Sentiment for November fell to a four-month low, from 59.5 to 54.7.

According to the UoM research, they predict inflation to rise from 2.9% to 3% over the next five to ten years, but 5.1% over the next year. The survey’s director, Joanne Hsu, stated that such entrenchment in the future is still conceivable due to the ongoing uncertainties surrounding inflation forecasts.

The traders’ response to the UoM poll was overshadowed by last Thursday’s CPI news. On Friday, the EUR/USD continued to rise after falling to its daily low of 1.0163 and then rising to its daily high of 1.0364.

Euro and USD Investors Heavily Pricing in a 0.50% Rate Hike from Us Fed

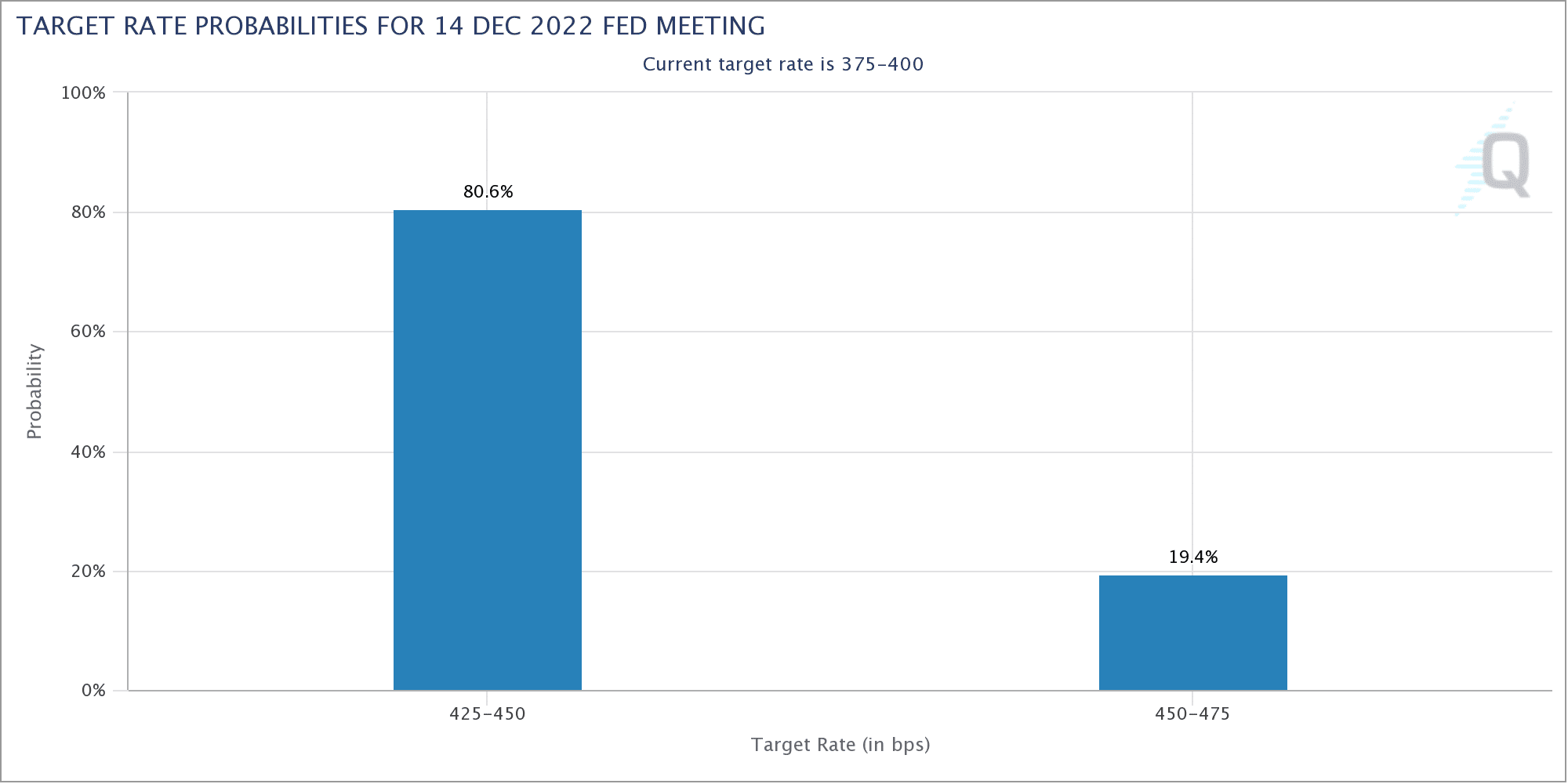

Investors are starting to factor in a Fed that is less “hawkish.” The CME FedWatch Tool demonstrates that following the release of US inflation statistics, money market futures are still pricing in a 50 basis point rate increase, with the probability hovering around 80.6%.

In line with expectations, the CPI in Germany for the Eurozone (EU) grew by 10.4% annually. The German Harmonized Index of Consumer Prices (HICP) increased by 11.6% year over year in October, as predicted, but by 0.7% more than in September.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.