The currency pair is bearish on both outlooks.

Buyers may take the leading sooner.

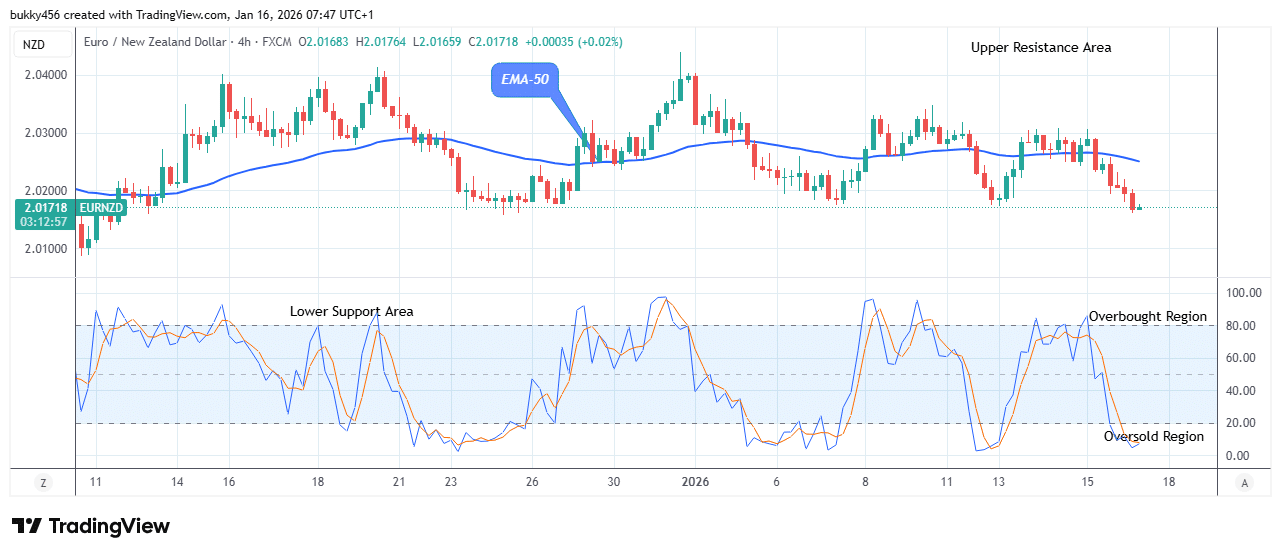

EURNZD Weekly Price Analysis – January 16

Today, the EURNZD pair is under selling pressure as the market remains bearish. Meanwhile, the market is poised for a bullish reversal, as it is already oversold and could be ready for an upward move. Thus, if the bulls increase the buying momentum, the currency pair price may reverse to the bullish pattern, and its upward movements may reach an upper resistance level of $2.06, providing a significant accumulation zone for buyers.

EURNZD Market

Key Levels:

Resistance levels: $2.03, $2.04, $2.05

Support levels: $1.93, $1.92, $1.91

EURNZD Long-term Trend: Bearish (Daily Chart)

The EURNZD pair is in a bearish market zone in its higher time frame, according to the chart below.

The drops on the currency pair in the past few days have brought the price to its recent low. Nevertheless, the bulls will take over the price of EURNZD and break the supply level as the selling pressure is exhausted.

The current price of EURNZD at the $2.01 support level, below the EMA-50, as the daily chart opens today, may experience a bullish turnaround as the selling pressure may not occur again.

Therefore, a push by the bulls could change the direction of the trend to reach the previous high of $2.06 and remain stable at the top range.

Notably, the stochastic oscillator is down at around 4% in the oversold region, suggesting a bullish reversal is imminent at the mentioned support.

As a result, the next target for the bulls may be the $2.08 upper resistance level in the coming days.

EURNZD Medium-term Trend: Bearish (4H)

The EURNZD pair anticipates an increase as it reverses and starts trending in its medium-term perspective.

The pair price remains below the supply level, suggesting a bearish trend.

The continuous pressure from the bears in the previous session has brought the price to its recent correction below the supply level. However, the bulls may take control as the price reverses.

The market value of EURNZD may break the resistance point as the bulls pullback and change the currency pair price to a $2.01 high mark below the EMA-50 shortly after the commencement of the chart today, indicating that positive sentiment is returning to the market.

It’s worth noting that the bears may lose control, and the upward trajectory could face another barrier above the resistance at a $2.04 supply as the price surges.

The stochastic oscillator signaling an uptrend at the oversold region indicates that the pair may increase further as the bullish trend continues.

Given this, the buying pressure may drive the EURNZD price to an upper resistance level of $2.06 in the days ahead as the pair reverses and starts to increase in its medium term.

Hence, buyers may wait for this action to stabilize before taking a position in the medium term.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.