The EURNZD market value could go higher.

The currency pair remains bullish in both outlooks.

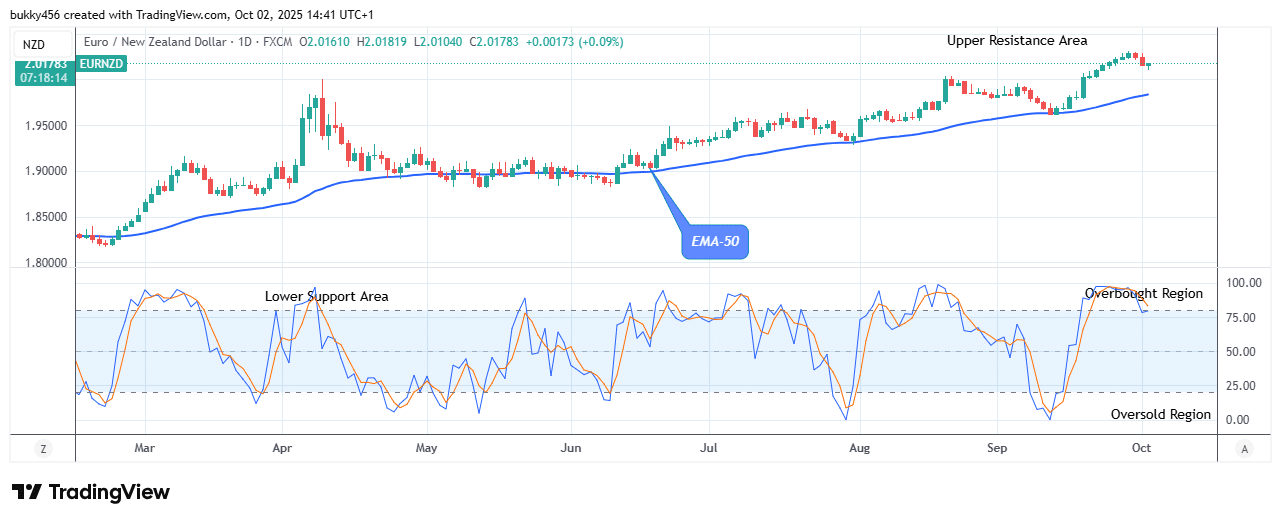

EURNZD Weekly Price Analysis – October 3

The EURNZD market is up. Amidst recent market fluctuations, the pair offers a suitable pullback at $2.01 high mark, trying to stabilize above the supply levels. Will the pattern hold true and trigger a fresh recovery? Thus, if buyers manage to break the pattern’s resistance trend line at the $2.03 high value, a probable relief rally might propel the market price to the $2.08 resistance mark and beyond, resulting in a turnaround for long-term traders.

EURNZD Market

Key Levels:

Resistance levels: $1.83, $1.84, $1.85

Support levels: $1.73, $1.72, $1.71

EURNZD Long-term Trend: Bullish (Daily)

The EURNZD price holds a recovery opportunity, offering a suitable pullback and remaining steady above the resistance levels in its long-term outlook. The price is above the supply levels, suggesting a bullish trend.

Today, the EURNZD buyers offer a suitable pullback at a $2.01 high mark above the EMA-50 as the daily session opens, bolstering a sign of recovery in the market.

The currency pair price, however, may soon retest the previous high of $2.03 due to strong purchasing pressure, giving it a stronger platform for further growth.

Furthermore, if the support level holds, there is a chance that the pair may increase even more, allowing buyers to push the price of the currency pair up to a high of $2.10 in the near future.

EURNZD Medium-term Trend: Bullish (4H)

The medium-term outlook is quite bullish. Buyers also aim at breaking up the previous high, restricting the bears’ pressure as the market price of EURNZD now trades above the moving average, suggesting a bullish trend.

The bullish pressure in the past session has sustained the currency pair price above the trend levels in its recent high.

After the recent market drop, the bulls made an impressive move up to the $2.01 resistance level above the EMA-50 shortly after the 4-hourly chart opened today.

Therefore, maintaining above the supply levels suggests a good chance of a bullish corrective and that the pair may rise. Thus, the positive pressure will be strengthened by a significant break over the $2.02 barrier level.

Similarly, the price signal pointing upwards indicates that the trend will remain in an uptrend if buyers can intensify their buying pressure in the market and prices break above the previous resistance trend line.

In this case, a bullish trend continuation to the overhead resistance of $2.10 is also possible in the medium-term outlook.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.