The currency pair still trades in a bullish market zone.

Sellers may likely resume dominating the EURNZD market soon.

EURNZD Weekly Price Analysis – February 28

EURNZD price anticipates more drops as the buying pressure is about to end and may break down the $1.74 prior support value. At the moment, the currency pair is positive. However, the price may collapse and break down the crucial support value if the bears could add more aggression to their selling actions in the market. The target might be the $1.74 lower support value, resulting in a selling signal for short traders.

EURNZD Market

Key Levels:

Resistance levels: $1.83, $1.84, $1.85

Support levels: $1.73, $1.72, $1.71

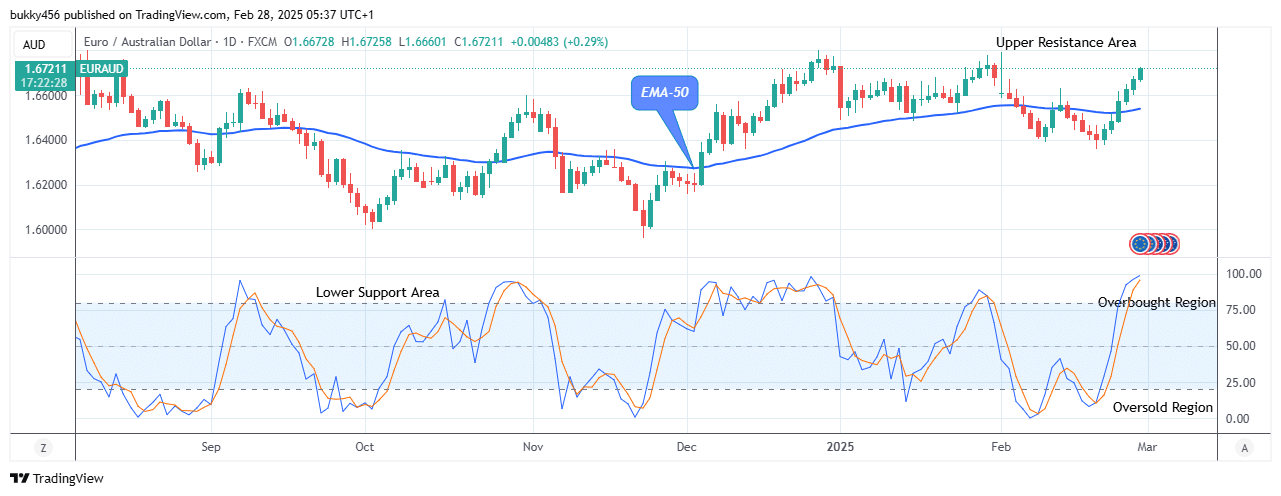

EURNZD Long-term Trend: Bullish (Daily Chart)

The EURNZD remains in a bullish trend. Meanwhile, the price may break down the support level as the buying pressure is about to subside in the long-term outlook. The price bar remains above the moving average, suggesting a bullish trend.

support level as the buying pressure is about to end.

EURNZD price on the daily chart today is above the EMA-50 at the $1.84 high level, indicating an uptrend. It also suggests that the bears are warming up to take over the trend as the buying session is about rounding off.

Meanwhile, the Yen price may break down the support value as soon as the market approaches the overbought region.

Therefore, if the bears increase their tension in the market, the price tendency may break down the $1.74 lower support value, leading to a sell signal for the short traders.

In addition, the daily signal is close to the overbought region, suggesting the buying pressure will soon end. As a result, the bears may take over the trend to break down the $1.74 lower support value in the coming days in its higher time forecast.

EURNZD Medium-term Trend: Bullish (4H)

The EURNZD pair has just resumed its bearish run and may break down the support level as the buying pressure seems to have ended in its medium-term outlook.

The market value of EURNZD may break down the low level as the bears dropped the pair to a $1.84 support value above the EMA-50 shortly after the commencement of the 4-hourly chart today, indicating that negative sentiment is returning to the market.

Thus, sellers must add more pressure to their activities to move the market beyond the current price level.

The pair is witnessing a change in trend. If the selling momentum persists, the Yen price might drop lower or break down to reach the $1.81 low level, footing the Yen market to drop more.

Notably, the EURNZD pair remains in a downtrend at the 91% range of the daily stochastic, suggesting more drops.

As a result, the pair could drop lower and break down the $1.81 prior support to hit the $1.74 lower support value in the days ahead in its medium-term forecast.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.