The EURNZD pair may experience reversal at the $1.88 support level.

Buy traders might take the leading afterwards.

EURNZD Weekly Price Analysis – June 6

The EURNZD pair is warming up for a possible reversal at the $1.88 current support value as the selling pressure is ending soon, reaching the oversold region. A bullish breakout confirmation that closes above the $1.98 resistance level would indicate that the market is feeling more optimistic. Due to this, buyers will have a stronger foundation to extend this recovery. Therefore, a post-retest rally could push prices higher and reach the resistance trend level of $2.00, if all support levels hold.

EURNZD Market

Key Levels:

Resistance levels: $1.83, $1.84, $1.85

Support levels: $1.73, $1.72, $1.71

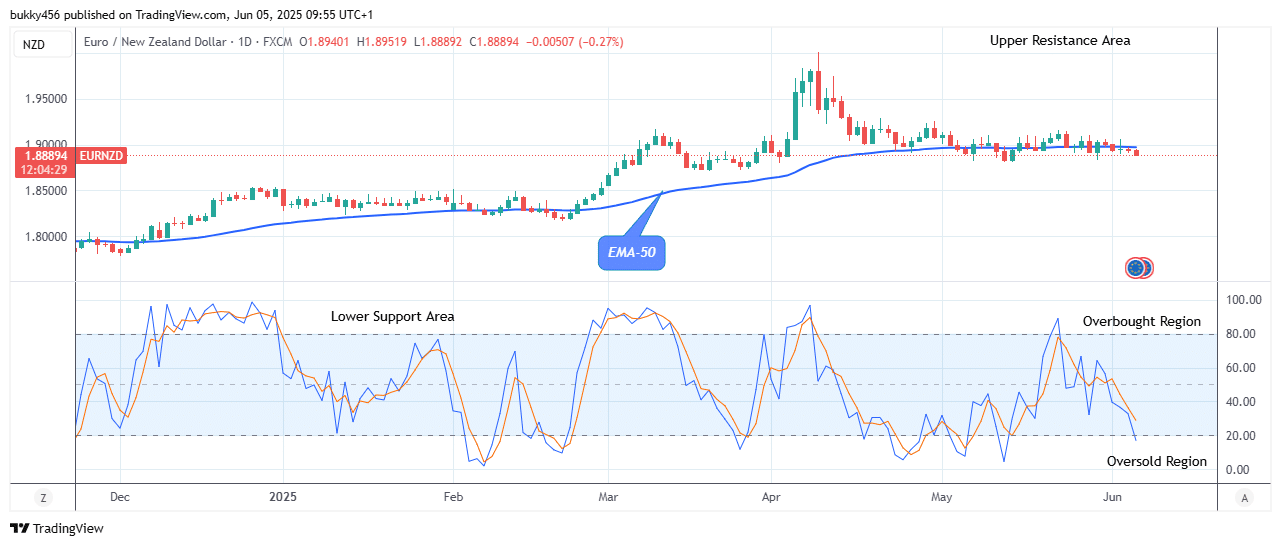

EURNZD Long-term Trend: Bearish (Daily)

EURNZD is on the verge of an upside reversal and has a bearish posture in the long term perspective. The price is below the EMA-50, indicating a downward momentum and the high impact of sellers in the market.

Hence, the currency pair is now oversold and is on the verge of an upside reversal.

The EURNZD price dropped even further today, reaching a low of $1.88 below the supply levels as a result of the sell traders’ actions.

However, if a renewed surge in buyers’ interest occurs, the Yen price may undergo an upside reversal at the $1.88 low level to retest the prior high of $1.98 level, providing buyers with great recovery potential,

In conclusion, the pair is on the verge of an upside reversal as the market has fallen to the oversold region of the daily stochastic, implying that the selling pressure is likely to end soon and will compel buyers to resume sooner.

Hence, the next bullish corrective pattern may extend to the $2.00 high mark in the days ahead in its long-term perspective.

Thus, buyers must wait for the action before taking a position.

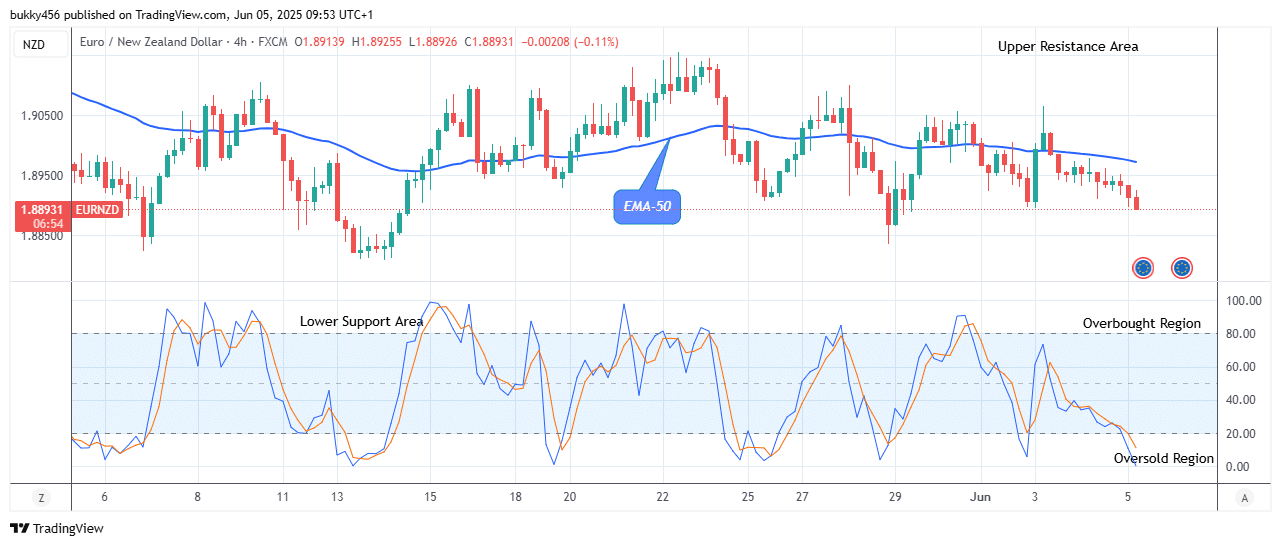

EURNZD Medium-term Trend: Bearish (4H)

On the medium-term chart, EURNZD is showing a downward movement and is still on the verge of an upside reversal. This is clear as the price continues to make lower highs and lower lows.

The market price of EURNZD drops further to a $1.88 low mark below the two moving averages as the 1-hourly session opens today due to low bullish momentum.

Thus, if buyers eventually wrestle trend control from sellers and rebound from $1.88 support, a positive breakout above the $1.91 high value is needed to confirm the potential Bull Run.

In continuation, the market price of EURNZD is in the oversold region of the stochastic, suggesting that the selling pressure has reached an exhaustion, the expected upside move in the price could be high at $2.00, level in the coming days in its medium-term outlook.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.