Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

The EURNZD bearish trend may continue.

The bears may take over the market.

EURNZD Weekly Price Analysis – August 8

The EURNZD bears may take over and continue with the bearish trend as new drops have just begun. The pair may experience more dumps as sellers are currently involved in the market activity. Thus, a further increase in bears’ pressure and sustained sellers’ enthusiasm may break down at the $1.81 level, propelling the Yen price towards the $1.79 lower support level, resulting in a good entry point for short-term traders.

EURNZD Market

Key Levels:

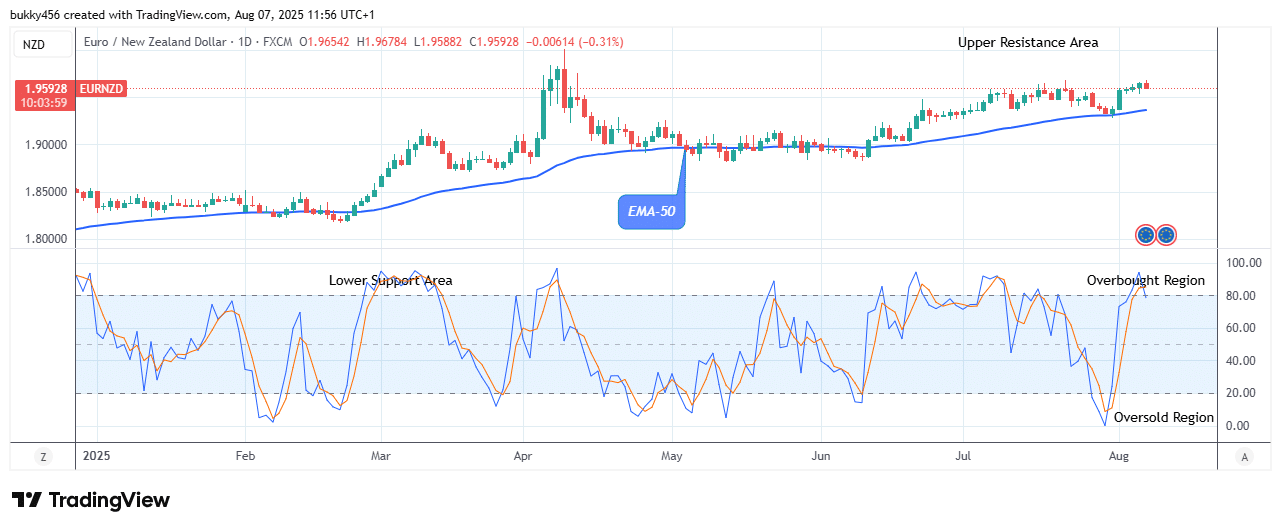

Resistance levels: $1.96, $1.97, $1.98

Support levels: $1.81, $1.80, $1.79

EURNZD Long-term Trend: Bullish (Daily Chart)

In the long term, EURNZD bulls may lose momentum if bears regain control above supply levels; this would signal a shift from bullish to bearish movement.

Sustained bullish pressure recently pushed the currency pair to $1.96, keeping the Yen price above supply trend levels during the correction phase.

The EURNZD price drop by the bears to a $1.95 support value above the moving average as the daily chart opens today is an indication of an uptrend in the context of the market strength.

Hence, the bears may take over if an additional effort is put in place by short traders into their selling motives; the price of EURNZD could turn negative to retest the previous low of $1.81.

In addition, the daily stochastic signals more dumps by pointing down; if aggressive pressure is added to the selling forces, the pair could drop further to retest the $1.81 prior support, and expose the currency pair to more dumps at $1.79 lower support mark in its long-term perspective.

EURNZD Medium-term Trend: Bullish (4H)

The EURNZD bulls are about to lose control over the market as buying pressure has subsided on the medium-term view.

Meanwhile, long traders may lose control sooner as the buying pressure seems to be subsiding.

The market value of EURNZD dropped to a $1.95 mark above the EMA-50 shortly after the commencement of the 4-hourly chart today, indicating that negative sentiment is returning to the market.

Thus, sellers need to increase their swagger to dump the market value beyond the $1.92 lower support level.

In addition, the signal of the daily stochastic points down, indicating the bulls may lose control, and the buying pressure is unlikely.

As a result, the $1.79 lower support level might be the target in the coming days in the medium-term forecast.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.