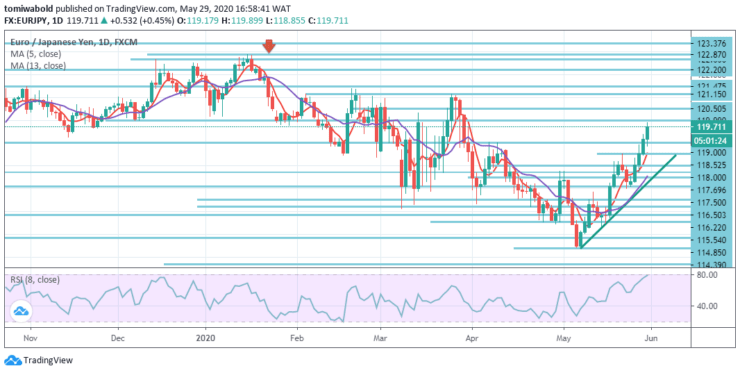

EURJPY Price Analysis – May 29

The common European currency climbed on Friday against the Japanese Yen by approx 80 pips or 0.75 percent. During today’s trading session, the currency pair crossed the horizontal barrier at the 119.00 level. The greenback is steadily losing ground amid changes to the month-end flows, as trade tensions in the US-China persist unfettered.

Key Levels

Resistance Levels: 122.87, 121.15, 119.00

Support Levels: 118.00, 116.22, 114.39

The currency pair crossed the upper horizontal level at 119.00 during today’s trading session before moving north for the test of the 119.99 level. All things considered, the EURJPY exchange rate could decline within the following trading session. Bear market investors are eager to force the market toward a level of 118.52.

However, if it recedes during the following trading session, a support cluster created by the moving average 13 and the ascending trendline at 118.00 level could further provide support for the currency exchange rate. Otherwise, sentiment in the event of a rebound may stay bearish.

EURJPY ‘s increase from level 114.39 is still ongoing and the decline from level 122.87 should at best be corrected. More increase might be seen initially as shown on the daily, to 121.15 resistance level. On the downwards, nevertheless, a breach of the support level of 117.08 may imply ending the rebound and shifting the bias back to the downside.

As EURJPY remains vulnerable in an upward bias in the near term, a breach underneath the support level of 118.00 may deliver weakness towards the support zone of 117.50/117.08. On the other side, one can see resistance near the price level of 119.99.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.