EURJPY Price Analysis – May 15

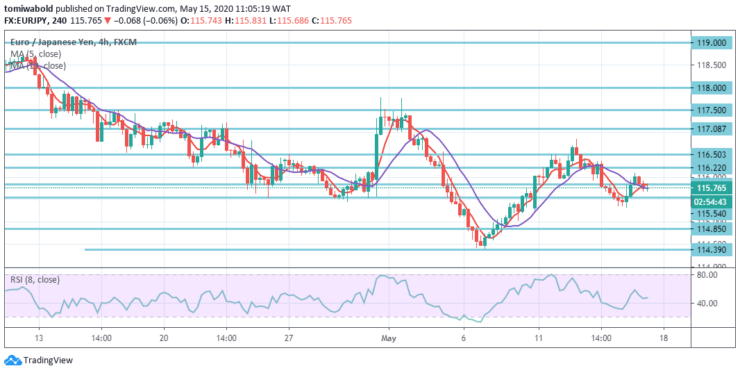

EURJPY stretches the leg higher after Friday’s breakout attempt seems to have run out of steam in the proximity of the 116.00 reference point. The continuing higher leg holds the potential to stretch further and to revisit the recent highs in the near-term horizon in the mid-116.50 range.

Key Levels

Resistance Levels: 122.87, 119.00, 116.50

Support Levels: 114.39, 113.70, 110.21

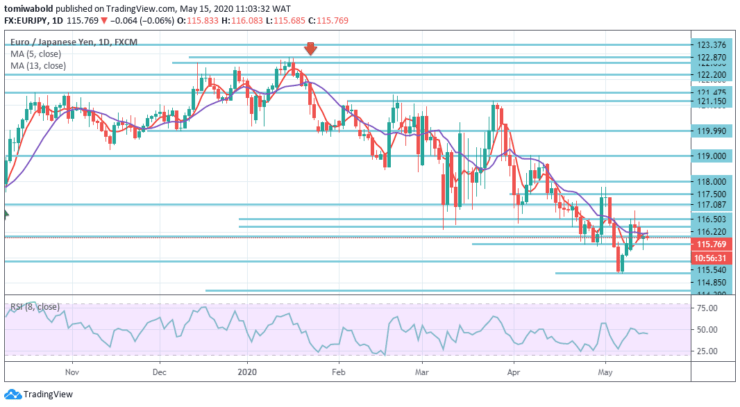

EURJPY Long term Trend: Bearish

The EURJPY exchange rate may begin to push higher during today’s session. Bullish market participants are inclined to seek a prevailing steady decline to the upper line at 116.50 level. Nonetheless, unless the currency exchange rate falls underneath the weekly pivot point at 115.83 level, a fall to the region of 115.54 level may be anticipated during the following trading session.

In the wider context, the downward trend from the level of 137.49 (high 2018) remains intact. EURJPY remains within the downward trend and underneath the downward moving average of 5 and 13. On the contrary, a breach of resistance level 122.87 is required to validate bottoming in the medium to long term. Without this, despite a rebound, the trend may remain bearish.

EURJPY Short term Trend: Ranging

Intraday bias in EURJPY remains primarily neutral. The corrective rebound from level 114.39 may widen. But instead to set aside trend continuation the upside may be far beneath 117.50 level of resistance. On the downside, the 114.39 level breach may attempt a prediction of 161.8 percent from 121.15 to 116.22 at 110.21 level next.

The selling momentum in the cross is expected to reduce a little beyond this level of resistance, today close to 116.50 level. The currency exchange rate, on the other hand, it may overturn the current price level at 115.84 and enable the upward movement today.

Note: learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.