EURJPY Price Analysis – April 30

After reaching fresh yearly highs at the 132.36 level during Thursday’s trading session, the EURJPY is trading on the defensive. It has taken positive steps almost throughout April. EURJPY stays under pressure amid weak German GDP shrinking by 1.7 percent in the first quarter, which was worse than predicted.

Key Levels

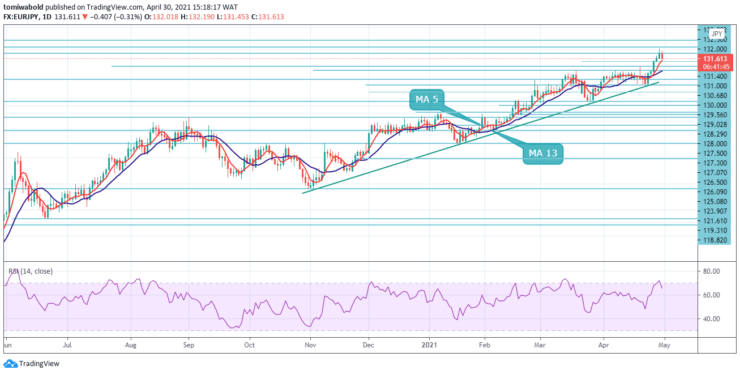

Resistance Levels: 133.00, 132.50, 132.00

Support Levels: 131.00, 130.68, 130.00

EURJPY is trading within the mid-131.00 mark, but below the recent peak. The pair reached daily highs of around 132.19 before settling at 131.45 as at the time of this post. The cross is currently losing 0.26 percent at 131.68 and confronts support at 131.40, then 131.00 (psychological level). A bounce above 132.36 (yearly high Feb.25), on the other hand, will reach a high above the 132.50 handles.

Looking at the broader picture, while above the moving average 5 at 129.80 level the outlook for the cross should remain constructive. The Relative Strength Index has made a bearish divergence pattern while the price is below the horizontal barrier at 132.50. The pair may continue falling as bears target the next support at the $131.00 level.

The intraday bias in EURJPY is altered slightly bearish at the upside channel with the present retreat. Meanwhile, some consolidations could be seen beneath the 132.36 temporary high. But further range trading is anticipated for as long as 131.00 resistance turned support level holds intact.

On the upside, above 132.36 level may restart the bullish trend from 128.29 to 130.68 to 129.56 from 130.20 at 132.50 next level. EURJPY has also moved above the moving average of 5 and 13 while the 4 hour RSI hovers above its neutral line. The pair may resume the upward trend to the 132.50 level.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.