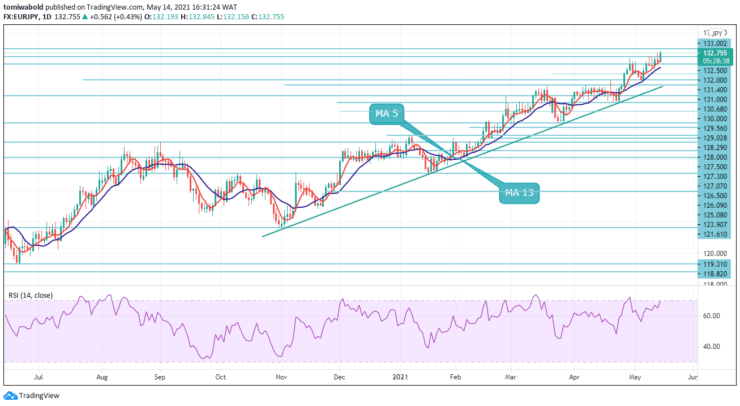

EURJPY Price Analysis – May 14

On Friday EURJPY pair, the euro surged 70 pips, or 0.45 percent, against the Japanese yen. The surge was supported by the overall positive sentiment surrounding the Euro on progressive vaccination of the eurozone and challenges of virus spread limiting the Japanese economy. Although at overbought zones at 132.84 level, the EURJPY continues with the upside run.

Key Levels

Resistance Levels: 134.00, 133.50, 133.00

Support Levels: 132.50, 132.00, 131.50

After breaking the horizontal resistance level at 132.50, the EURJPY has made another bullish break past the prior high at 132.73 level. However, the price action is approaching a vital resistance zone at the 133.00 regions. As a result, depending on how price reacts to support and resistance levels, this chart analysis can reveal both bullish and bearish scenarios.

The completion of the bullish surge could be confirmed by a bearish breakout below the horizontal support level at 132.00 level. A strong bullish breakout at the 133.00 horizontal resistance level could signal further upside and sustain the bullish scenario. The overall bias remains positive as the pair trades above moving average 5 at 132.20, indicating that the cross’s outlook remains positive.

The EURJPY’s intraday bias remains strongly to the upside, and range trading from the 132.50 high may continue beyond 133.00 high. However, if the 133.00 resistance region holds intact price retracement is anticipated within this session or the next.

On the upside, a break above the high at 133.00 may relaunch the uptrend from 132.00, with a 100 percent projection of 129.56 to 132.36 from 131.00 at 133.50 levels next. Meanwhile, the 133.00 level’s resiliency can shift the bias to the downside, implying a deeper drop to the 131.00 support level.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.