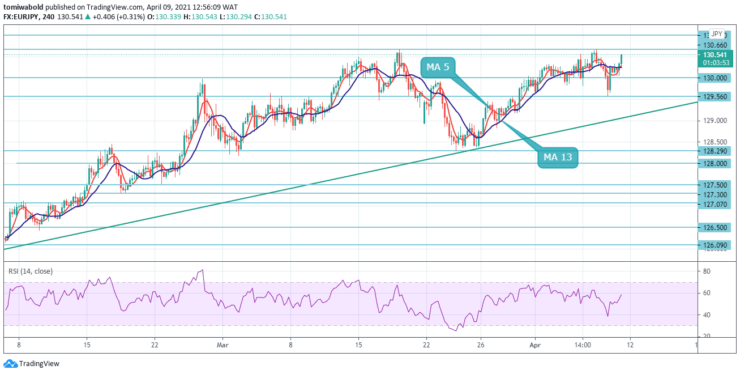

EURJPY Price Analysis – April 9

During Friday’s European session, the EURJPY picks up steam from the prior day’s recovery at the 130.00 level and continues to pursue higher levels around the 131.00 regions. The pair will have to overcome a 130.66 upside barrier to improve its traction towards the 131.00 level. The firm daily recovery in US yields supports a selling bias around the Japanese safe haven, bringing the EURJPY cross closer to its yearly highs around 130.66.

Key Levels

Resistance Levels: 131.50, 131.00, 130.66

Support Levels: 129.56, 128.29, 127.50

As seen on the daily chart, EURJPY has so far managed a 130.67 high; further strength eyes 131.00 high level, which can smoothen the path up towards the key markers of 132.06 and 134.42 levels. The pair is currently trading at 130.43, up 0.24 percent, and a break above the 130.66 resistance zone would take it to 131.00, a new year high.

Initial support, on the other hand, is at 130.00, followed by 129.56 (the prior day’s low) and finally 128.29. (March low). In the meantime, the rise from 114.39 is seen as a medium-term phase of growth within a long-term consolidation pattern. As long as the support level at 119.31 remains unchanged, steady growth is predicted.

So far, the EURJPY pair has been unable to break through resistance at 130.66 level, and the intraday bias remains neutral. On the downside, a break of minor support at 129.56 level would extend the consolidation from 130.66 level and result in a new drop.

On a break of the 128.29 support level, the intraday bias will be switched back to the downside. However, the downside should be contained above the 127.50 resistance level, which has now turned into support. A decisive breach of 130.66 level on the upside will restart the entire rally from 114.39 level.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.