EURJPY Price Analysis – March 26

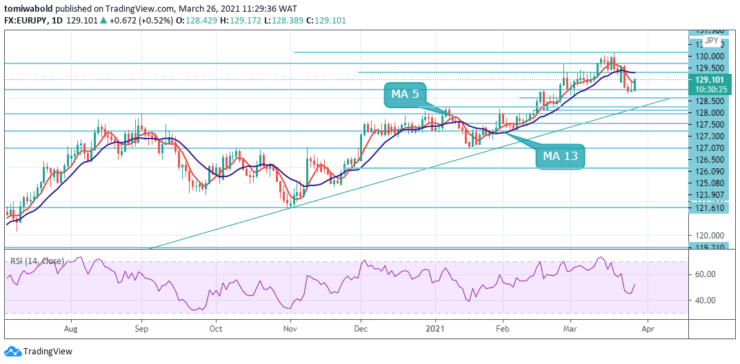

EURJPY gains extra momentum and rebounds from the level at 128.38 during the European session on Friday. The pair will contend with an upside barrier of 129.50 level at the end of the week against the backdrop of the prevailing risk appetite trend in the global markets as the German IFO Business Climate beat estimates with 96.6 points.

Key Levels

Resistance Levels: 130.65, 130.00, 129.50

Support Levels: 128.50, 128.00, 127.50

In the larger sense, the lift from level 128.38 is seen within a long-term uptrend as a medium to long-term bullish return phase. As long as the 128.50 support level holds, a further advance is anticipated. The potential target for bullish traders would be near the MA 13 near the 129.50 level.

The markets could indicate that the price may test the top border at 129.50 level and then resume moving downwards on a break of 128.50 to reach 128.00 level in subsequent sessions. Meanwhile, the bearish scenario may no longer be valid if the price breaks the topside border and fixes above 130.65 level.

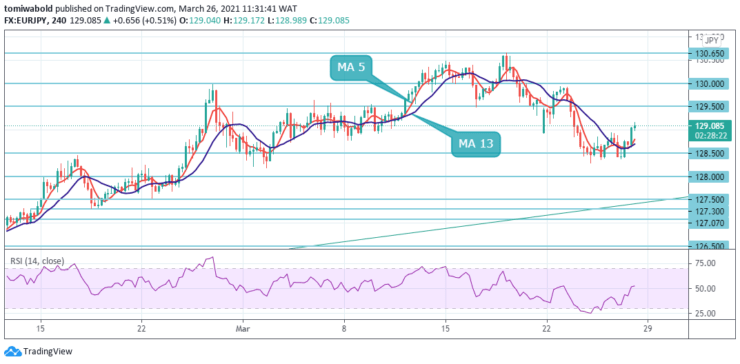

The intraday bias in EURJPY stays in a range for the moment. Correction from 130.65 short-term high may extend lower. But the pair’s downside arrangement may be contained past the 127.50 resistance altered support to usher in a fresh rebound. On the upside, past the 129.50 support, altered resistance may change intraday bias back to the upside for approaching the high level at 130.65.

From the momentum indicators perspective, the RSI is moving upwards in the positive region, while the MA 5 and 13 crossing is increasing in momentum below price and back to the bullish territory. Overall, EURJPY traction is following the upside structure of the price. Should the pair manage to strengthen its upside tendency, the next target could come around the peak of 130.65 level.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.