EURJPY Price Analysis – March 12

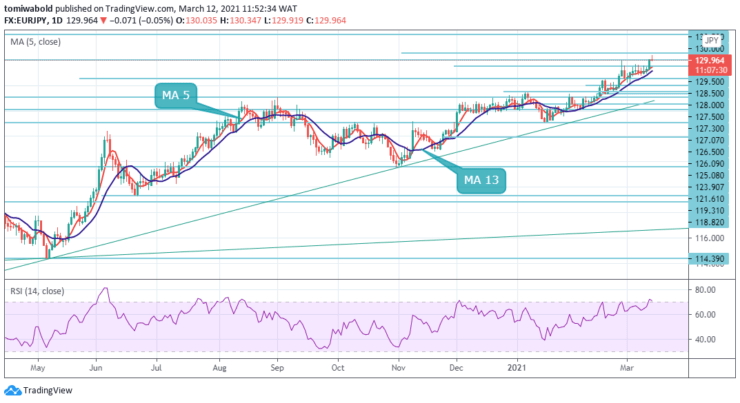

EURJPY has declined rapidly after ascending to the high level at 130.34 level during the early European session on Friday. The currency pair breached the 130.00 psychological zones to hit a fresh intraday high at 130.34 marks. Investors were not convinced by the ECB’s report and are worried about Europe’s lagging vaccine campaign.

Key Levels

Resistance Levels: 133.12, 131.98, 130.50

Support Levels: 128.50, 127.50, 126.50

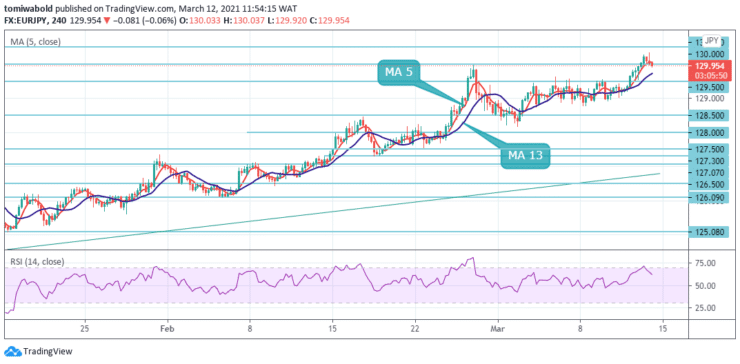

The exchange rate fell from 130.34 high and bearish traders may likely attempt to push the EURJPY down during the trading session. The relative strength index (RSI) is at the overbought zone hence the recent correction lower. However, the 129.50 support level and MA 50 zone could support the exchange rate in the medium term.

In the larger context, the increase from 114.39 low level is seen as a medium-term increasing phase inside a long-term ascending trend. Further upside is anticipated as long as 128.50 support holds. The next target is 137.49 (2018 high). However, a solid breakout of 127.50 could provide confidence that the rally from 114.39 has ended and brought attention back to that low.

EURJPY’s uptrend restarted by surpassing the 129.50 recently hits as high as 130.34 so far. The pair’s intraday bias is back on the upside. Meanwhile, the present advance from 121.61 should target a 100% forecast of 121.61 to 127.50 levels from 125.08 at 130.50 levels next.

On the contrary, the breach of 129.50 minor support may alter bias neutral again initially. On the upside, above 130.00 level may hold the bulls intact. EURJPY has also moved above the moving average of 13 while the 4 hour RSI hovers around its top end. The pair may resume the downward trend to 127.50 level.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.