EURJPY Price Analysis – January 15

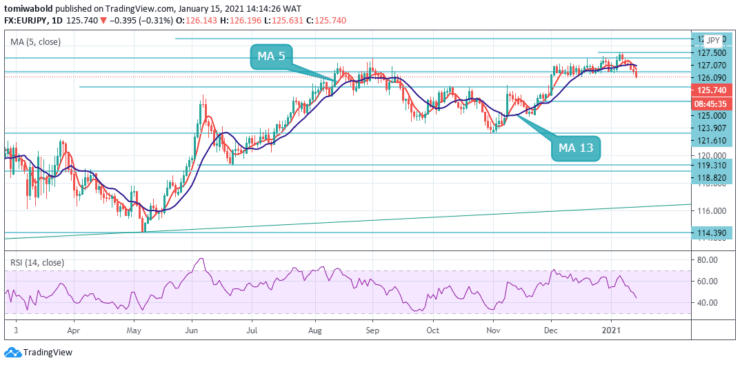

The common European currency has declined versus the Japanese Yen for 6 days in a row at the same time to sub 126.00 level while exiting the week in a negative zone. The currency pair is exchanging under the moving average of 5 and 13. The upside potential against the JPY could be limited due to a combination of factors such as ECB fiscal policy.

Key Levels

Resistance Levels: 127.50, 127.07, 126.09

Support Levels: 125.00, 123.90, 121.61

EURJPY initially opened higher on Friday at 126.14 and traded to 126.19. The pair pulled back, bears appeared as traders turned their attention to levels below 126.00. To begin exploring the bearish scenario, it is necessary to establish a decisive fall below 125.00. The pair may continue to decline with a potential target for bearish traders around the sub 125.00 level.

In a broader context, growth from 114.39 is seen as a mid-term phase of growth within a long-term consolidation trend. Further gains are anticipated as long as the 119.31 support level is held. However, a solid breakout of 119.31 would prove that the rally from 114.39 has ended and has brought this low back into focus.

EURJPY is still in a range from 127.50 high, and initially, intraday bias remains tilted to the downside. Another rise is expected if the resistance at 125.00 stays as support. On the other hand, a decisive rebound past 126.00 will resume full gains from 114.42.

The next target will be the mid-term level of 128.67. On the other hand, a break of revised support at 125.00 could reverse the downtrend to widen the range from 127.07 with another phase of decline.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.