EURJPY Price Analysis – February 12

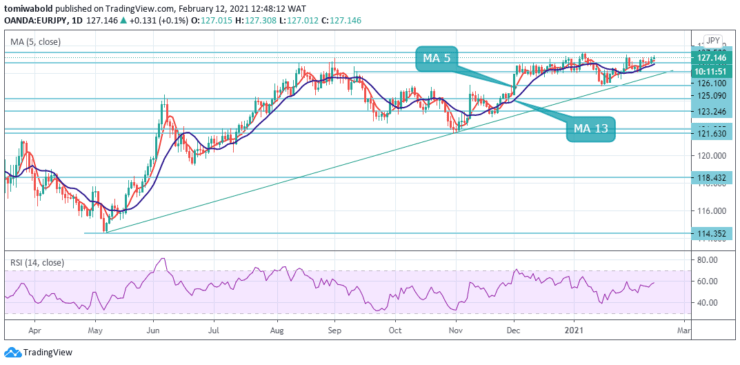

The EURJPY pair increases after crossing beyond the 127.00 level during Friday’s European session. It adds to the recent upside move after reclaiming the round figure. Following the price action caused by persistent weakness surrounding the Yen, EURJPY appears to sustain buying interest.

Key Levels

Resistance Levels: 130.18, 128.67, 127.50

Support Levels: 126.10, 125.09, 123.24

At the moment the cross is gaining 0.07% at 127.10 level and confronts the next upside resistance at 127.50 (2021 high) level followed by 130.18 (high) level and then 133.13 (high) level. On the flip side, a plunge beneath 126.10 (low) level would aim for 125.09 (low) level and finally 124.13 (low) level.

In the larger context, the advance from 114.35 level is seen as a medium-term increasing phase inside a long term ranging trend. A continuous advance is anticipated as long as the 121.63 support level holds. However, a firm breach of 121.63 level may suggest that the increase from 114.35 has finished and alter attention back to this low.

The intraday bias in EURJPY stays neutral as the range trading from 127.50 is increasing. In the scenario of another plunge, the downside should be contained by a 125.09 support level to usher in a rebound. On the upside, a decisive breach of 127.50 level may restart a larger increase from 114.35 level, to 128.67 level.

A the moment, a continuous rally may be seen to retest the high at 127.50 level. On the other hand, a breakout of the 125.09 area could push the trend back to the downside towards the 121.63 support level. All things being equal, the EURJPY pair may continue upwards during the next trading session.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.