EURJPY Price Analysis – August 28

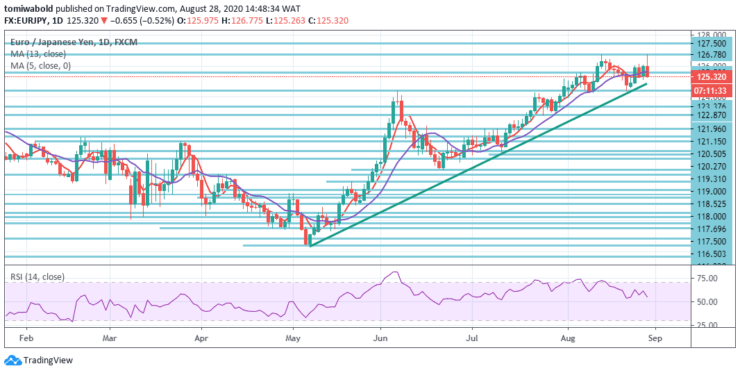

Upside risks have controlled the single European currency against the Japanese Yen since the prior trading session. EURJPY drops nearly 70-pips from fresh yearly highs at 126.77 level in the last hour, mainly on news that the Japanese Prime Minister Shinzo Abe is expected to step down from his position due to deteriorating medical conditions.

Key Levels

Resistance Levels: 137.49, 128.67, 126.78

Support Levels: 124.43, 123.37, 121.96

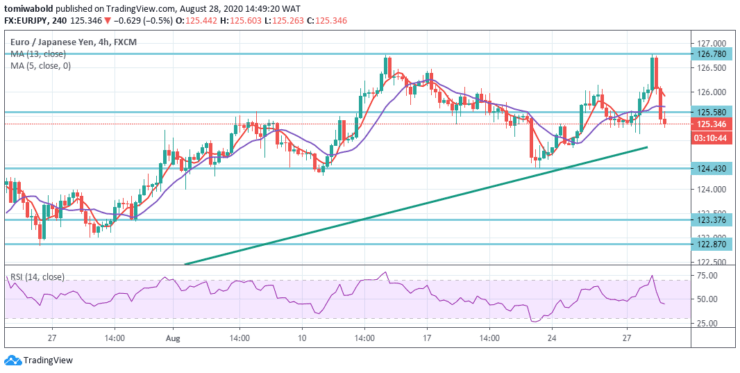

Within this session, bulls are likely to persist to press the exchange rate higher. The possible target for bullish traders will be close to Level 127.00. Even so, during the following trading session, the currency exchange rate is poised to make a minor retracement toward the ascending trendline support around 125.00 marks.

The continuous breach higher opens the path for a level of 137.49 (high). For now, this may remain the preferred scenario as long as the horizontal support line (now at level 123.37) retains. Even so, a prolonged breach of the ascending trendline support may rekindle medium-term bearishness at a later stage for another low beneath 114.42 marks.

At this point, the intraday bias in EURJPY stands firm. As long as there is a support level of 124.43, more rally is in support of it. On the upside, a 126.78 level breach may restart rallying from level 114.42.

Regarding the state of bearish divergence in daily RSI however, a firm breach of 124.43 level may validate short-term topping. The intraday bias is switched to the downside for the horizontal support line (now at level 123.47), to correct the rally from level 114.42.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.