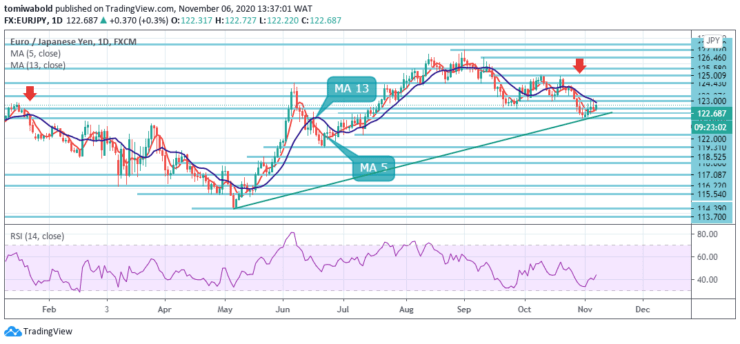

EURJPY Price Analysis – November 6

EURJPY extends the rangebound trading following the recent bounce from lows beneath 122.00 level towards the 123.00 marks. The US presidential election has intensified, and it certainly appears to be a divided Congress. The Fed is ready to deliver more stimuli. All attention is on the US NFP and the outcome of the election.

Key Levels

Resistance Levels: 127.07, 125.00, 123.00,

Support Levels: 121.61, 119.31, 117.08

As seen in the daily chart, recent lows at 121.61 may contain potential bearish moves, while the 123.00 area is holding the upside for now. Further, as long as EURJPY is above the key moving average 5 at 122.37, it is expected to maintain positive bias unchanged.

In a broader context, growth from 114.39 is seen as a medium-term growth phase within a long-term consolidation trend. Further rise is anticipated while the support level of 119.31 is held. A breach of 127.07 may aim for a 61.8% rebound from 137.49 (high) to 114.39 at 127.50. However, a solid breakout of 119.31 would be an argument that the rally from 114.42 has ended and will draw attention to this low.

The intraday bias of EURJPY stays sideways for now as it continues to range from the temporary low of 121.61. A steeper fall may remain in support as long as the 125.00 resistance level stays, even in the event of a strong rebound.

A breach of the temporary low of 121.61 may restart the plunge from 127.07 to 61.8% retracement from 114.39 to 127.07 at 119.25 levels, which is near to the key support level of 119.31. However, the lower border of the ascending trendline may provide support for the exchange rate in the short term.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.