EURJPY Price Analysis – August 21

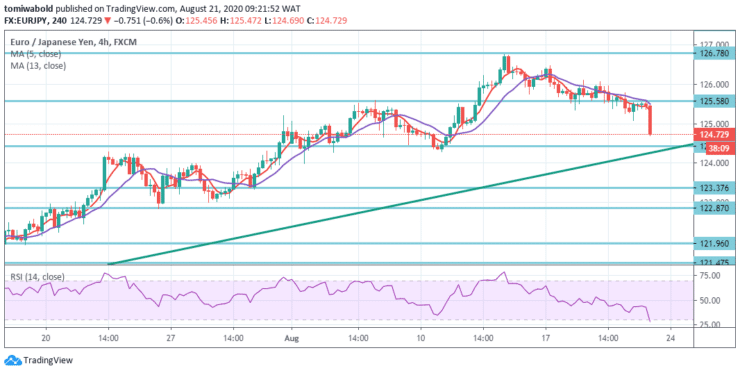

Following last week’s 2020 highs close to level 126.80, EURJPY has proceeded on a corrective downside, which is now experiencing its 5th straight session. Early in the European session on Friday, the eurozone’s single currency declined by 65 basis points or 0.40 percent against the Japanese Yen as of when writing.

Key Levels

Resistance Levels: 137.49, 128.67, 126.78

Support Levels: 124.43, 123.37, 121.96

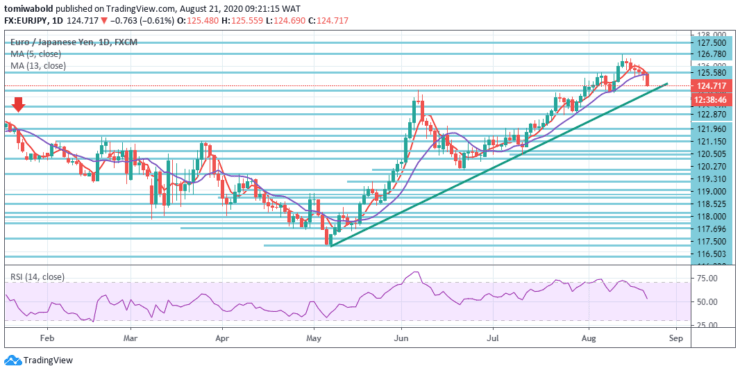

The daily chart of the EURJPY pair below demonstrates different cycles, which underscores the fractal nature of the price action. Further downside is therefore likely and could drag the cross as low as the 124.43 zones, or last week’s low. If the selling impetus picks up pace, then the next key contention area is located near the 122.87 level.

Despite the ongoing move, the constructive view around EURJPY is predicted to remain unchanged while above the ascending trendline support at 124.00 level. Against this, there is quite a moderate contention area in the 124.43/30 band ahead of the vicinity of the 122.87 level.

EURJPY stays in consolidation from level 126.78 and intraday bias stays initially neutral. Over 124.43 support levels should be found below the retreat to carry another rally. On the upside, the 126.78 breach aims a 100 percent prediction of 114.42 to 124.43 levels at 129.32 levels from 119.31.

Even so, the 124.43 level break may imply short-term topping and turn bias to the downside to pull back. While in the short-term horizon the cross may enter a short moment of consolidation, further downside should not be ruled out.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.