Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

EURCHF Analysis – Sellers Could Regain Control Next Week

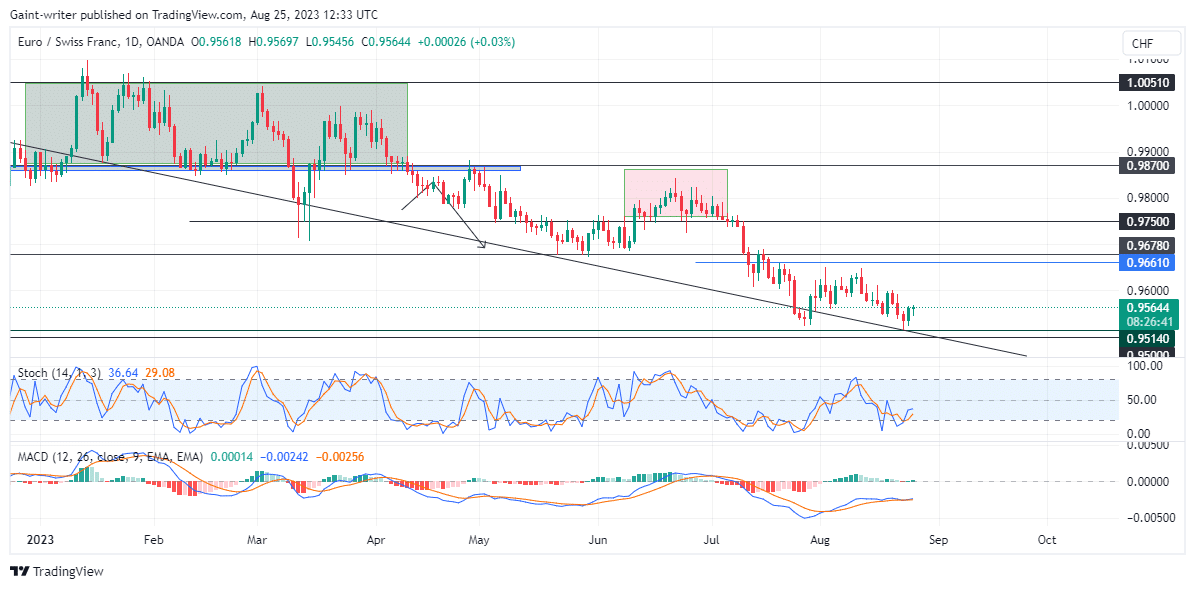

EURCHF traders are closing their trade with bullish gains, but market dominance is still lacking from the bulls. Instead, the price has been in a bearish trend. After a period of consolidation, the ongoing situation in EURCHF suggests a pullback in price due to selling pressure. The bearish trend started after the market broke free from consolidation above the 0.98700 level. Since then, bears have been active as the price continues to decline.

EURCHF Market Levels

Resistance Levels: 1.00510, 0.97500

Support Levels: 0.96610, 0.95140

As the week comes to a close, buyers are seen closing up their positions. A temporary easing of bearish pressure is expected next week due to the buying attraction at the 0.95410 level. The Stochastic Oscillator on the daily chart suggests a buying option for now. However, sellers are still eying a potential breakout to the downside as the trade progresses.

Market Expectation

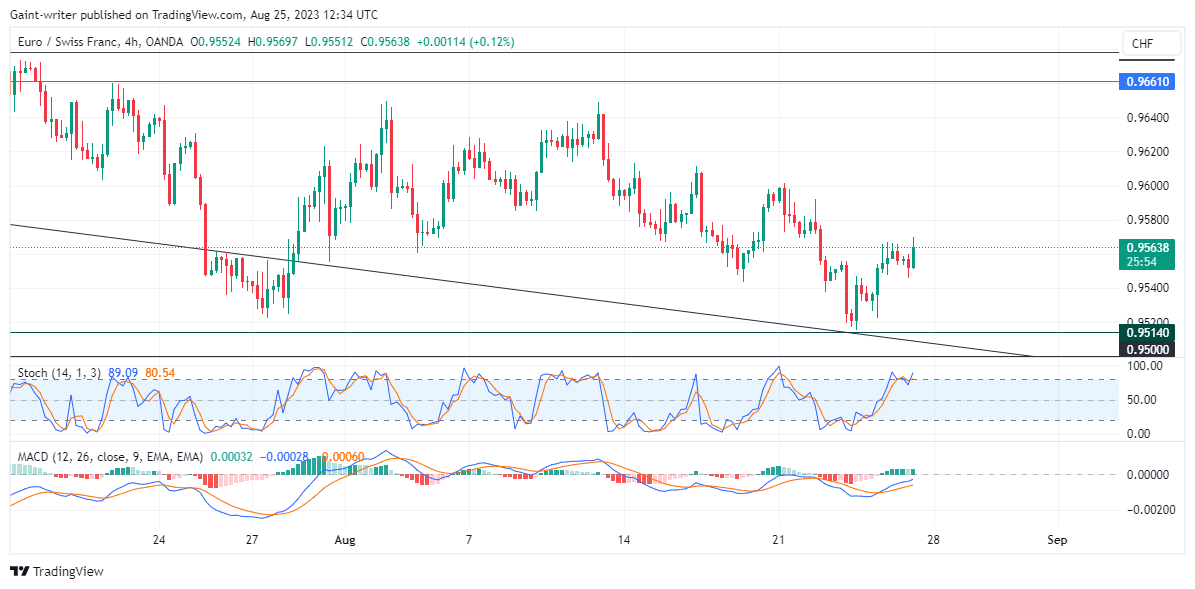

On the 4-hour chart, the bulls are gaining strength, which may be considered a pullback in the market. However, selling pressure is still expected to intensify in the upcoming days. EURCHF Traders looking for bearish opportunities should key into the flow.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.