EURCHF Analysis – November 15

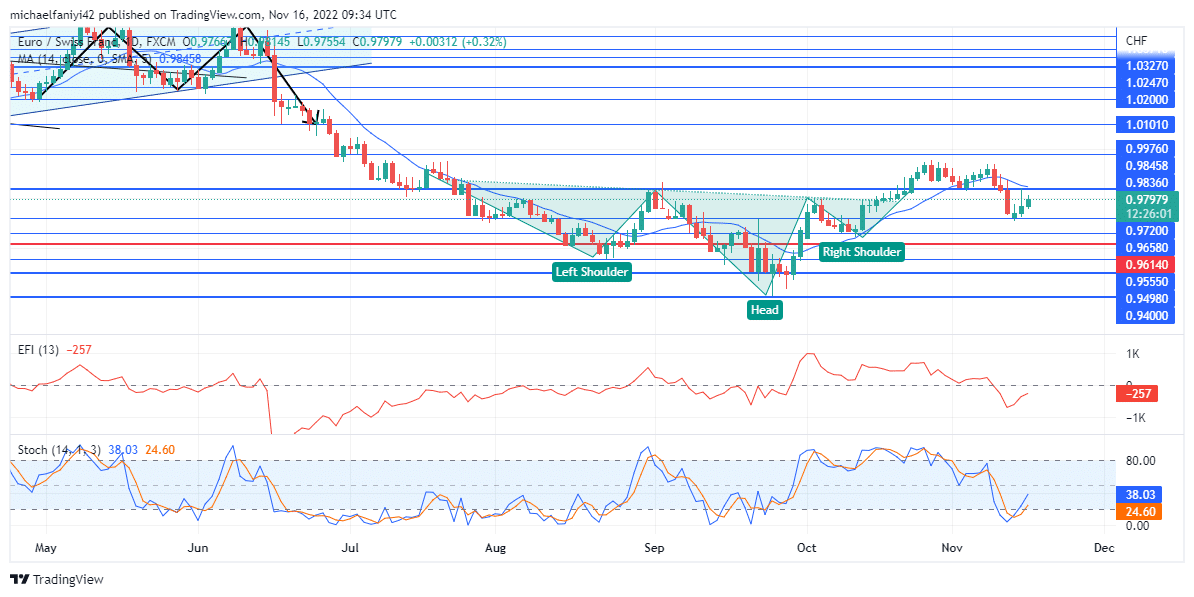

EURCHF slips from above the 0.98360 key level upon its second attempt to test the level. Since hitting a depression some weeks ago, the market has been strongly bullish. The price conformed into a bullish structure to pump the current pair beyond several key levels, including the 0.98360 major resistance level. However, after ascending above the level, the price slips below it on the second retest. Will EURCHF continue its rise?

EURCHF Critical Levels

Supply Zone: 0.98360, 0.99869, 1.01010

Demand Zone: 0.94000, 0.96140, 0.97200

EURCHF Short-Term Trend: Bullish

Immediately dropping to the new market low of 0.94000, the price was relieved of downward strain, allowing a beleaguered buying base to take over. They immediately began to pump the market, taking advantage of the current market structure and making a higher low to form the inverted head-and-shoulders bullish reversal formation. With this, the bullish prospects became even stronger.

The market eventually breaches the major resistance level at 0.98360 and having expended much energy, there is a need for a retracement before the price continues its uptrend. This does not go as planned, and the EURCHF returns to the level. As a result of the slip, the sellers have a temporary hold on the market, as shown by the EFI (Elders Force Index) line plunging to a negative value. The Stochastic had also dropped to oversold.

EURCHF Short-Term Trend: Bullish

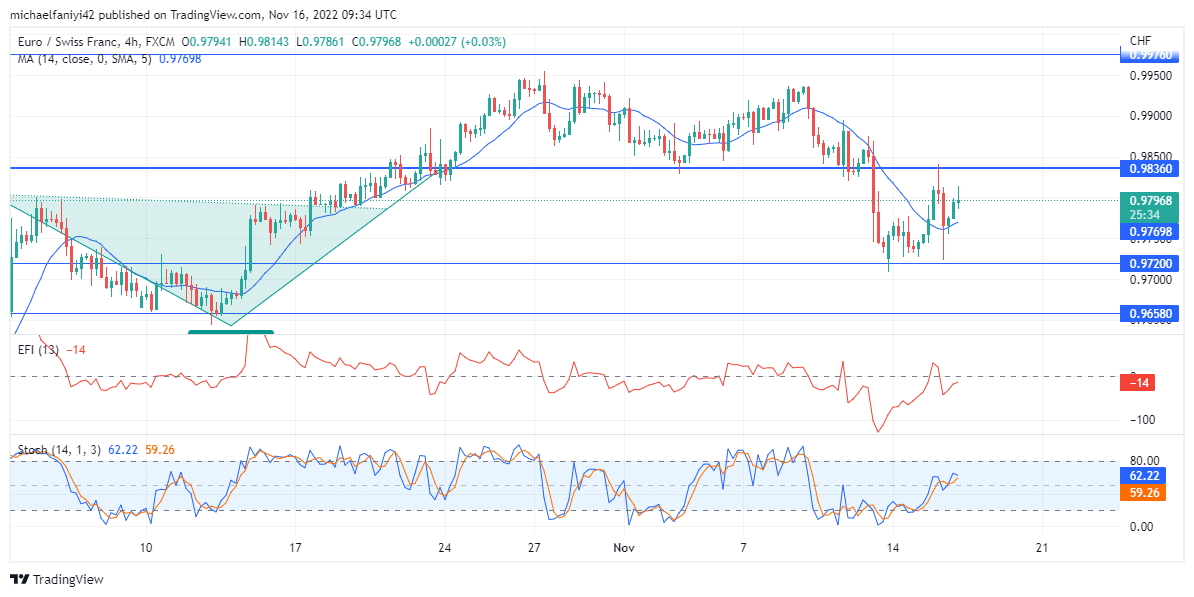

Nevertheless, the market shows there is still an impetus to recover and continue its uptrend movement. The price has immediately bounced off the 0.92700 key level, looking to breach the 0.98360 level again. This causes a sharp upturn in the Stochastic line and especially the EFI line, which rises back above and becomes a positive value on the 4-hour chart. EURCHF is predicted to re-breach the resistance and continue its uptrend movement.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.