EURCHF Analysis – November 29

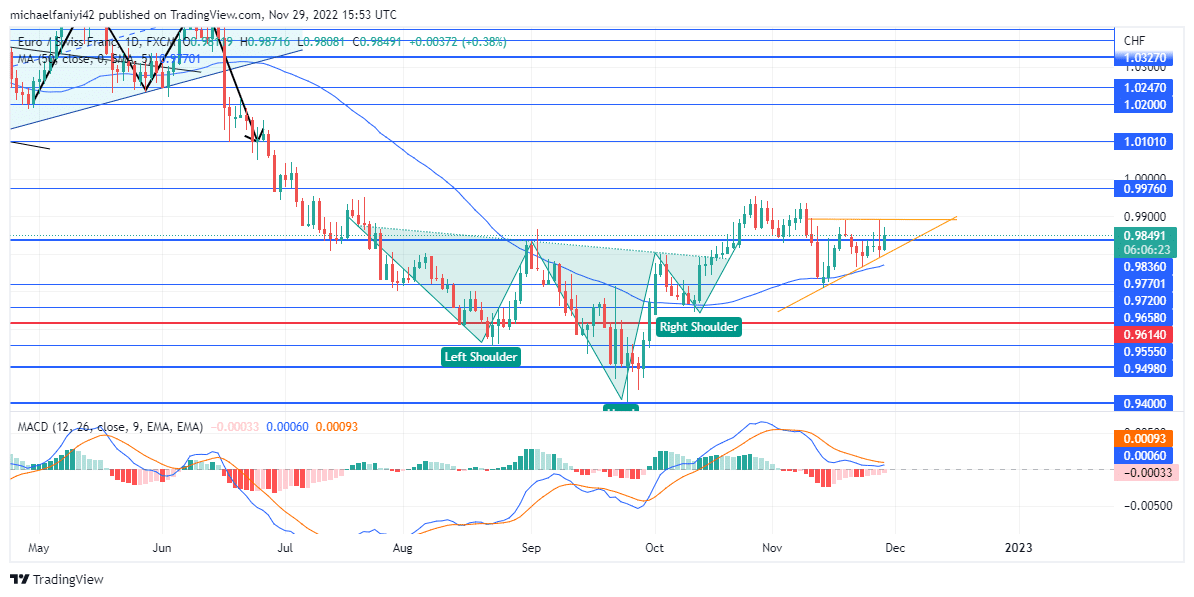

EURCHF seeks reinforcements to preserve its rising market. The market can be considered to be well and truly on an uptrend. However, in recent times, the buy-traders have weakened due to much exertion when trying to drive the market from its lowest point ever. Their challenge has thus far revolved around the 0.98360 key level. The price comfortably exceeded the level, only to fall below it and struggle since.

EURCHF Key Levels

Resistance Levels: 1.03270, 0.99760, 0.98360

Support Levels: 0.94000, 0.97094, 096140

EURCHF Long-Term Trend: Bullish

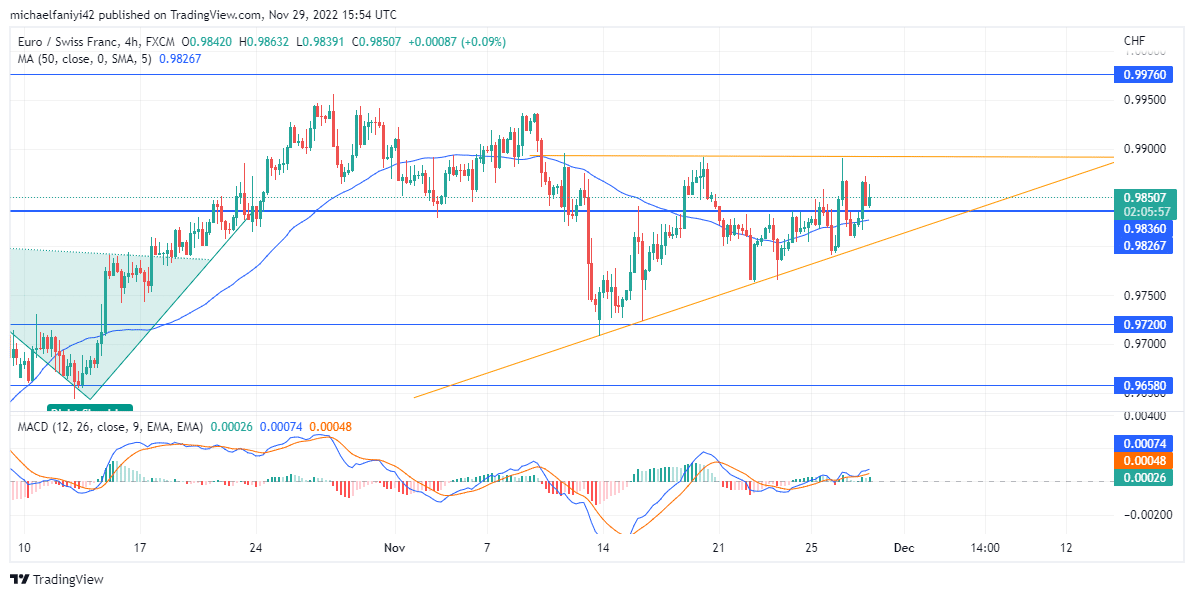

The buyers are currently struggling around the 0.98360 critical level. So far, they have been unable to maintain their position above sea level. The market now seeks bullish reinforcements with which it can preserve itself from continuously slipping downward. EURCHF is now adjusting into an ascending triangle structure, which is meant to hold the market for a while and then shoot it upward.

As the price tapers through the triangle structure, there is a cause for much optimism among the buyers. The MACD (Moving Average Convergence Divergence) lines which hitherto were already dipping, have been tempered just before reaching the equilibrium level, and now the lines are about to cross upward as the bearish histogram also successively reduces in height.

EURCHF Short-Term Trend: Bearish

Also contributing to the buyers’ cause is that the MA period 50 (Moving Average) is bearing the market both on the daily and the 4-hour chart. The MACD lines, which had plunged into a negative value before, have climbed back into a positive value, and the histogram bars have also turned green. EURCHF is expected to heave itself back above 0.98360 before rising towards 1.03270.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.