Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Market Analysis – September 18

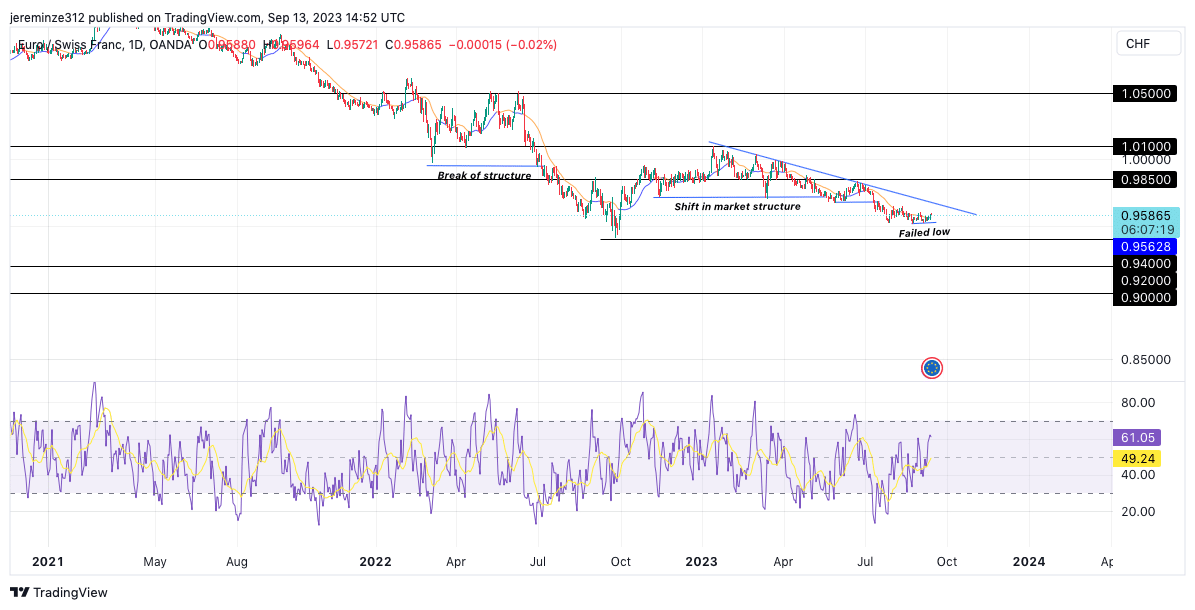

EURCHF price movement potential impact might be a bullish trend. EURCHF price has experienced a significant decline after breaking its previous structure. This downward movement started in early June 2022 and continued until late September 2022. Following this final leg, the price began a notable pullback that persisted throughout April.

EURCHF Key Levels

Demand Levels: 0.94000, 0.92000, 0.90000

Supply Levels: 0.98500, 1.01000, 1.05000

EURCHF Long-Term Trend: Bearish

EURCHF price movement shattered its structure in early June, suffering a sharp and substantial loss when it failed to surpass the 1.05000 level. Subsequently, the price started rising but encountered resistance around the 1.01000 mark.

I

However, the price trend passed through a significant change in mid-May when it established a lower low after reaching the 1.01000 level. This indicated a resumption of the initial bearish trend, suggesting that the retracement had concluded.

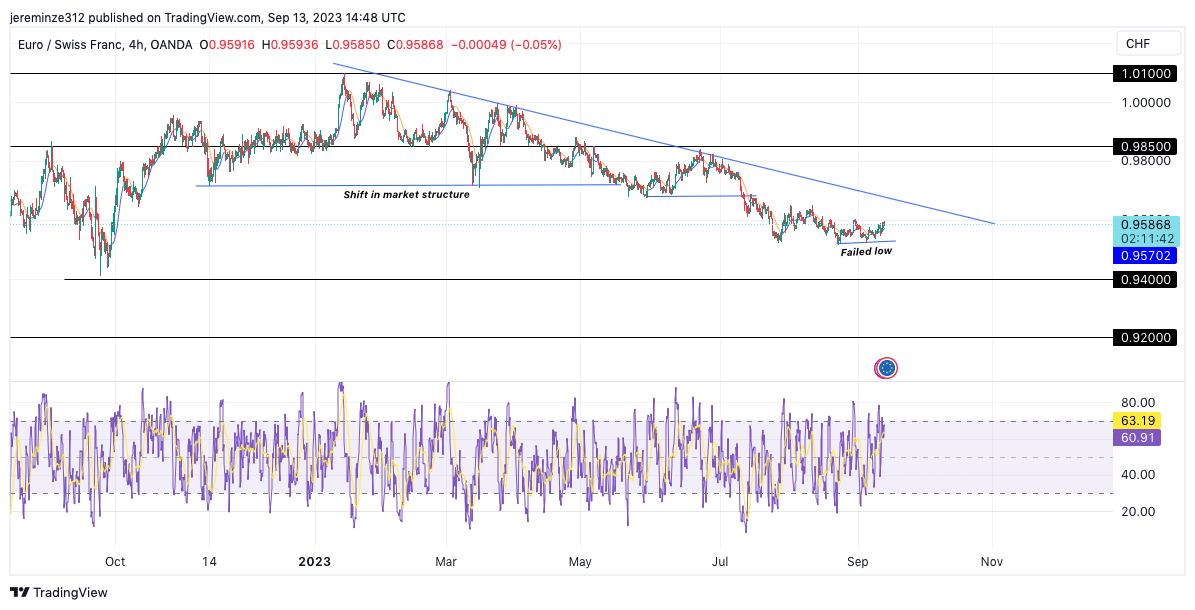

EURCHF Short-Term Trend: Bullish

Despite the overall bearish nature of the price, there is a possibility of a bullish move. The failed low suggests that the bearish trend is temporarily pausing in the form of a retracement.

I

Furthermore, the price being above the moving average indicates a tendency towards bullishness. Currently, the price is undergoing a pullback to gather liquidity, which will potentially fuel its downward drive towards the 0.94000 barrier.

I

Do you want to take your trading to the next level? Join the best platform for that here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

9.8

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

9

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

9

Learn to Trade

Never Miss A Trade Again

step 1

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

step 2

Get Alerts

Immediate alerts to your email and mobile phone.

step 3

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.