Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Market Analysis – November 8

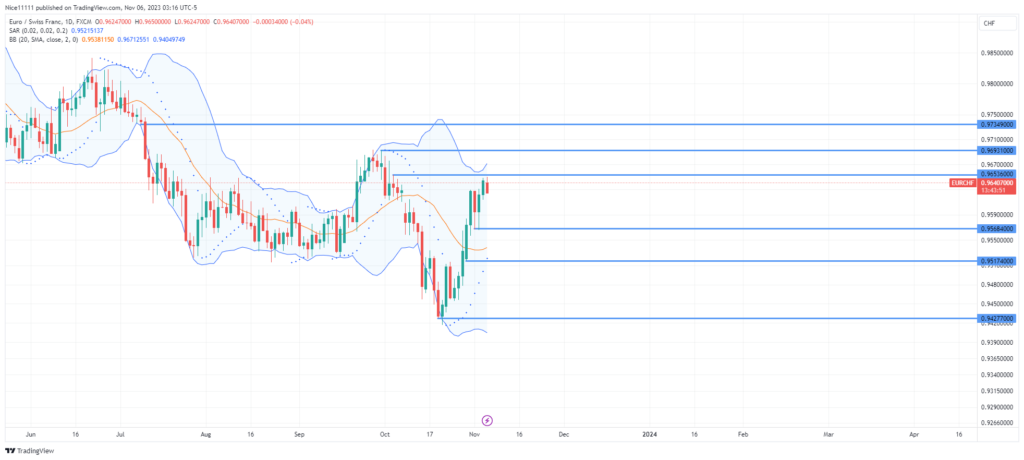

EURCHF price draws towards the major liquidity pool resting at September’s high. The major high of 0.9690 is serving as a price magnet on the daily chart. This has fostered the formation of a steep upward slope.

EURCHF Key Levels

Demand Levels: 0.9570, 0.9520, 0.9430

Supply Levels: 0.9650, 0.9690, 0.9730

EURCHF Long-Term Trend: Bullish

The daily chart for EURCHF reveals a swing high at 0.9690. The swing high was created as a result of a pullback into an inefficiently traded market region. A consolidation preceded the retracement, and it was abundant in August and early September. A sweep above the range into the fair value gap led to the resumption of the downward trend. A consistent decline in price was witnessed until the demand level of 0.9420 was struck.

The previous high formed before the demand level of 0.9420 was hit was taken out immediately. The speed of the market’s ascent from the support level deposited a gap of 0.9520. The current upthrust of the market is characterized by three white soldiers, which reveals the strong buy momentum.

EURCHF Short-Term Trend: Bearish

The price has moved above the Moving Average period 20 lying within the Bollinger Bands. This is the same on the daily and 4-hour chart. The Bollinger Bands indicator therefore supports the market ascent on the lower and higher time frames. A pullback to the Order Block resting on the 0.9570 support level is expected to be tested in order to propel the price to 0.9690.

Do you want to take your trading to the next level? Join the best platform for that here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.