EURCHF Analysis – October 18

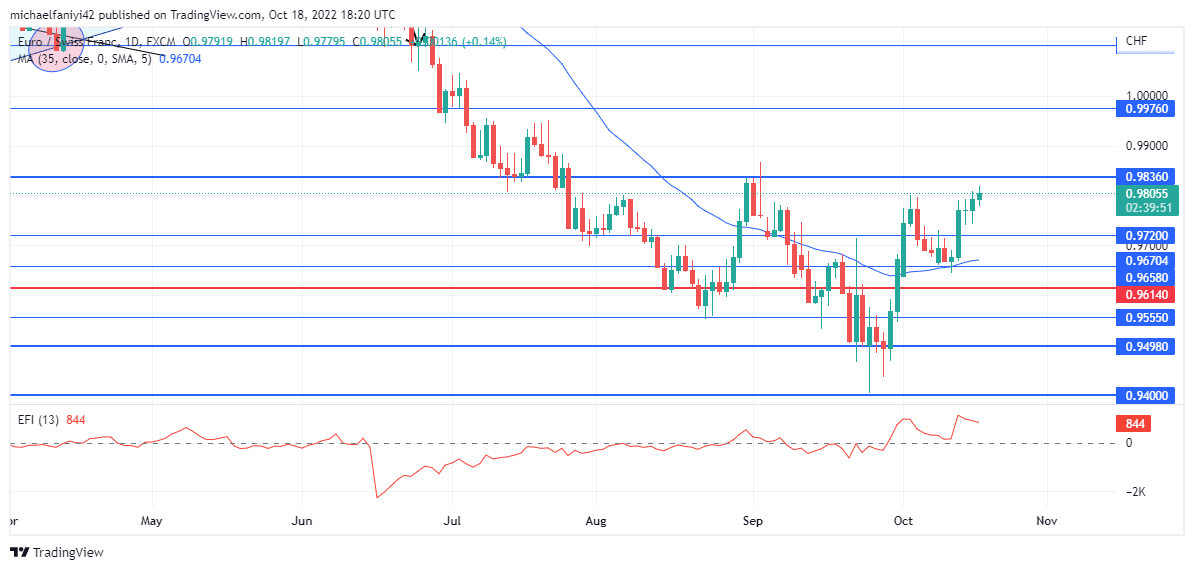

EURCHF leverages on a strong demand zone to push higher. The buy-traders have begun engineering an uptrend after the price hit rock bottom over the past one month. The market dropped to an entirely new low at 0.94000. This was especially possible because the currency pair was blocked at 0.98360. The bears have loosened their tension on the market, allowing the buyers to begin a rebuild.

EURCHF Critical Levels

Resistance Levels: 1.01010, 0.98360

Support Levels: .96580, 0.96140

EURCHF Long Term Trend: Bullish

The 0.96140 key level has shown the potential to be very critical for the market. It resisted the plunge in the price on the 23rd of August, such that the coin bounced back upward from it. However, the market was blocked at the 0.98360 resistance level. This then led to another drop in the price. The selling momentum was stronger in the second drop on the 20th, hence the 0.96140 key level was broken through.

After the market plunged to a new low, the bearish tension ceased.

This enabled the buyers to begin a build-up from that record low. Consecutive bullish candlesticks were used by the market to push directly above the 0.96140 key level. EURCHF then retraces and leverages at the 0.96580 key level. The MA period 34 (Moving Average) forms a strong confluence with the 0.96580 key level to push the price upward.

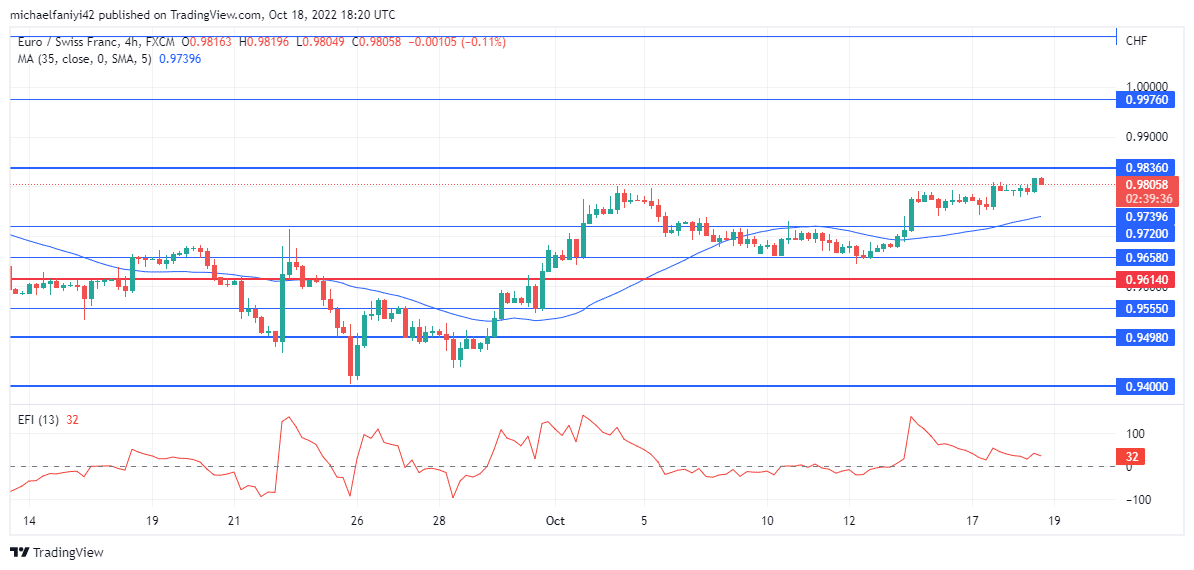

EURCHF Short Term Trend: Bullish

The EFI (Elders Force Index) line on the daily chart is highly positioned on the EFI (Elders Force Index) chart at a positive value. This is the same situation on the 4-hour chart. Although the current market retracement has caused the power line to bend towards the zero line. Meanwhile, the MA period 35 is still acting below the candlesticks and acting as support for the price to break the 0.98360 resistance level.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.