EURCHF Analysis – November 1

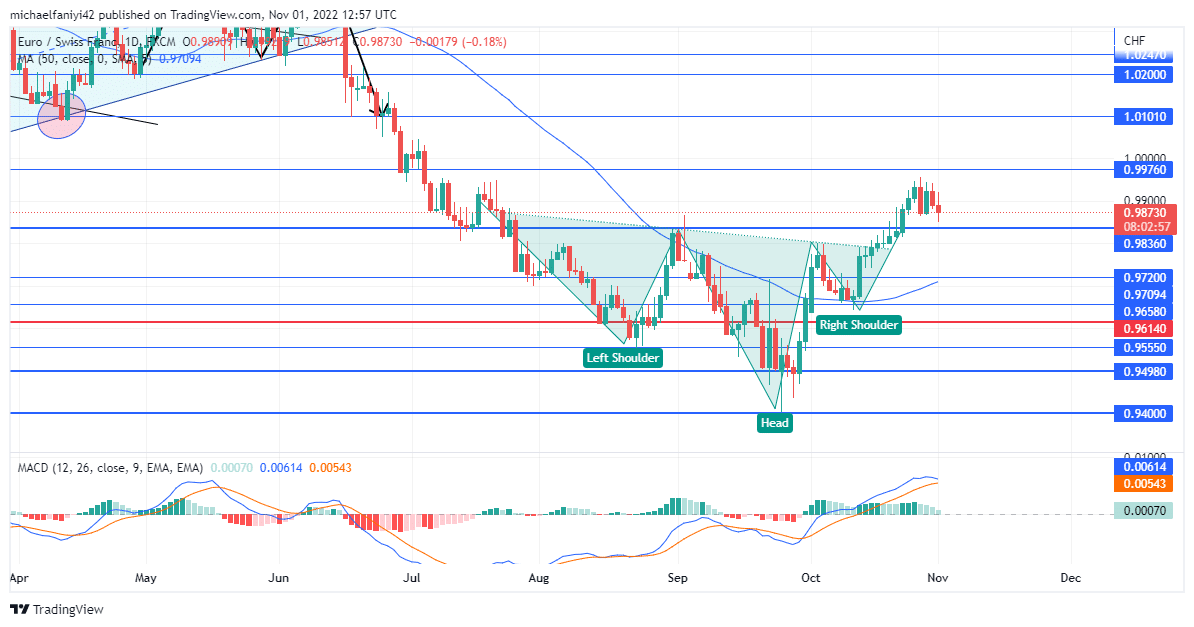

EURCHF is set to retest the 0.98360 critical level before it climbs to higher price levels. The market has done tremendously well to pick itself up from a very disastrous September, which saw it reach its lowest price level ever. The currency pair quickly conformed into an inverted head-and-shoulders formation, which pushed the price above the 0.98360 barrier. EURCHF is expected to retest the same level before continuing to rise.

EURCHF Key Levels

Resistance Levels: 1.01010, 0.99760, 1.03270

Support Levels: 0.94000, 0.97094, 0.98360

EURCHF Long-Term Trend: Bullish

At the beginning of September, the buyers tried to prevent the continuous fall but were firmly blocked at the 0.98360 resistance. This then led to the plunge to the lowest ever level. After that, the sellers dwindled as the bulls tried to regroup. The buyers took advantage of the structure on the ground to pattern the market into a bullish reversal head-and-shoulders formation with which it eventually breaks 0.98360.

EURCHF, having broken the 0.98360 barrier, is now set to retest it from above to push further forward. The MA period 50 (Moving Average) is firmly below the daily candles to show the upward trend of the market. The indication from the MACD (Moving Average Convergence Divergence) is that the market is strongly bullish, with lines high above the zero level accompanied by bullish bars.

EURCHF Short-Term Trend: Bullish

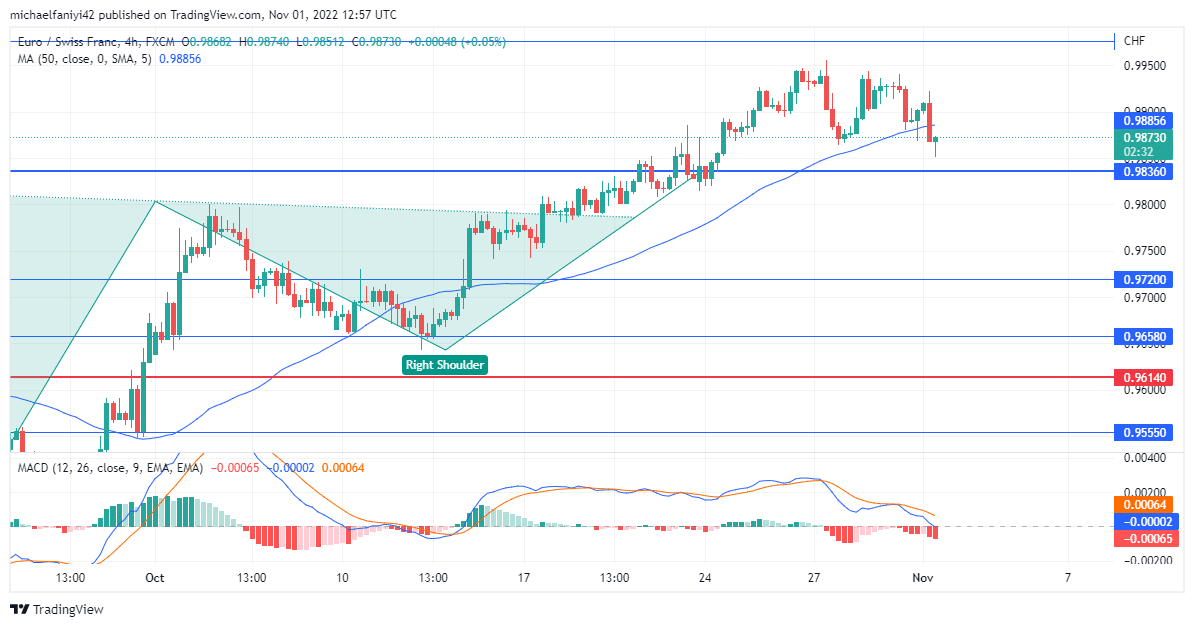

On the 4-hour chart, the candles have touched down on the 0.98360 level, which has turned into a support level. The price is expected to begin an immediate reversal. The retracement of the market has seen the MACD lines droop, but they are expected to rise imminently. The MA period 50 will also act as a support cushion for the price. The next target for the bulls lies at 1.03270.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.