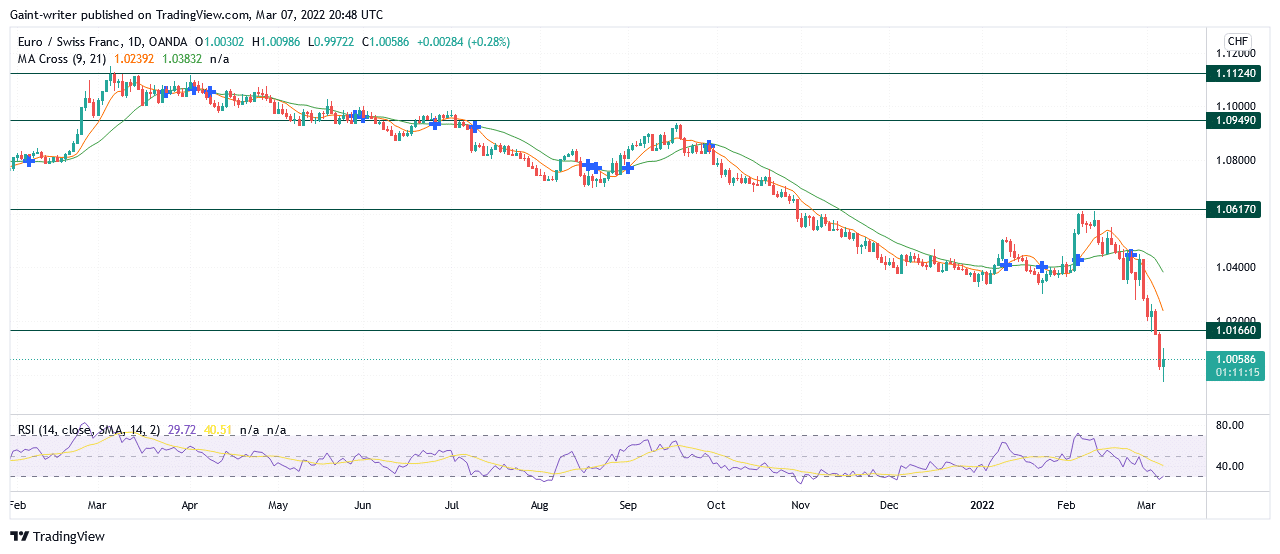

EURCHF Market Analysis – March 8

EURCHF is expected to return to the 1.01660 market zone during the bearish slump. The market has been in a bearish seasonal disposition for a long time. The sell traders have been closing all gaps in the market, shoving through several key levels where price orders can be found. The bearish ordination will likely continue for a while. However, the buyers are currently taking hold of the price at its current level. A pullback to the 1.01660 critical level is anticipated before the bearish phase continues.

EURCHF Key Levels

Resistance Zones: 1.11240, 1.09490

Support Zones: 1.06170, 1.01660

EURCHF Long Term: Bearish

The market circulation in the price analysis first shows the buyers’ contribution to the market. The long traders successfully pushed the price level up to the 1.11240 critical level. Due to buyers failing to purchase at a price above the 1.22240 level, the price began a downtrend. A change in price tendency occurred at this level. The EURCHF market, however, began to wield a price trend in a bearish order phase.

The market action breaks through the 1.06170 critical level with the price trend still on display. However, buy traders influenced the movement as the price returned to the 1.06170 critical zone before the bearish status plunged lower, breaking through the 1.01660 market zone. As the price progresses in this direction with the Moving Average confirmation, the bulls are still willing to drive the price back to 1.01660 before further plunging.

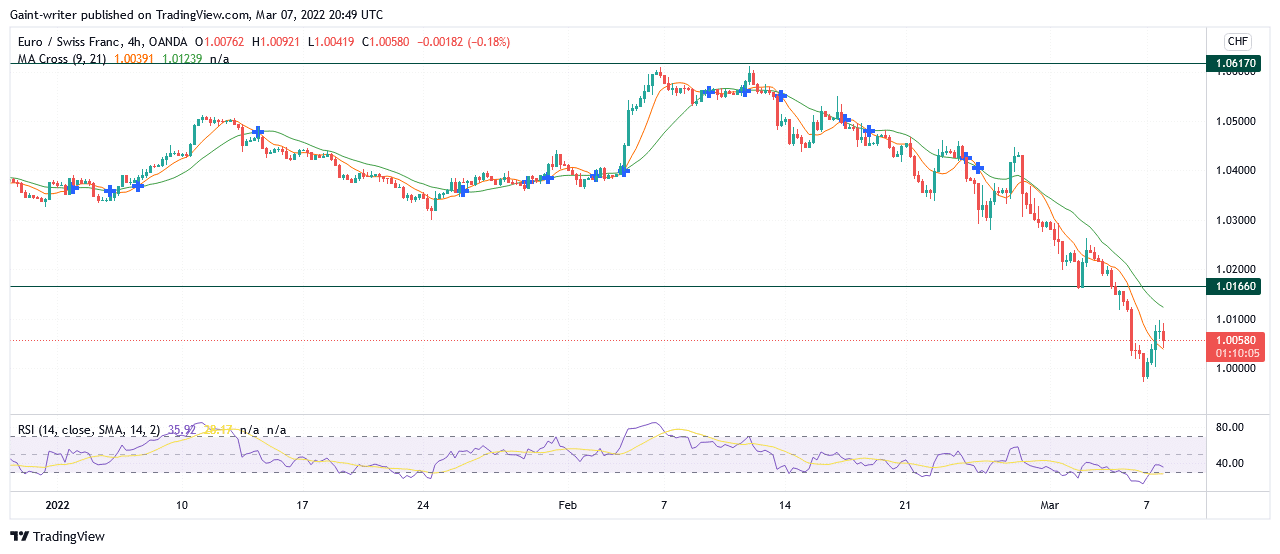

EURCHF Short Term Trend: Bearish

The RSI (Relative Strength Index) shows price movement close to crossing into the sell region on the 4hr chart time frame. With the buyers’ willingness in the market, the price will eventually withdraw back to the 1.01660 key zone before further bearish movements.

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.