EURCHF Analysis – November 22

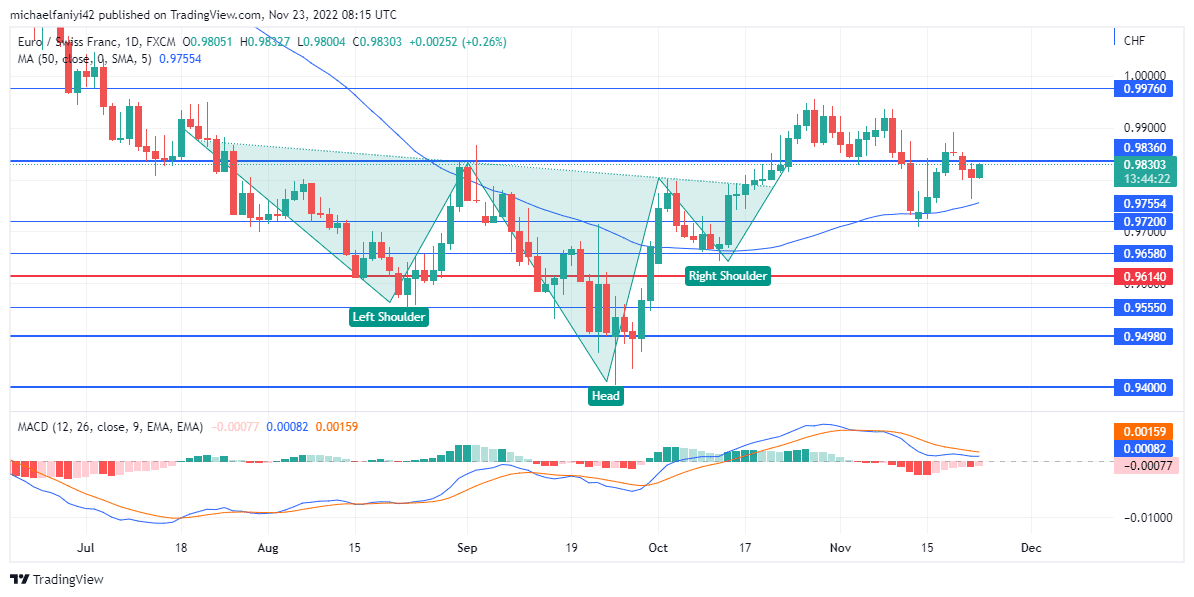

EURCHF is contending with the 0.98360 supply level to make a further upward movement. Though the price has been bullish in recent times, however, the strength of the buyers has waned, and the currency has now hit a blocker at the 0.98360 supply zone. Currently, the price has fallen below the level once more and will look to recover quickly.

EURCHF Key Levels

Resistance Levels: 1.01010, 0.99760, 0.98360

Support Levels: 0.94000, 0.97094, 096140

EURCHF Long-Term Trend: Ranging

The continuous bullish ride of the market, which began in late September, has now been tempered. During the bullish ride, the market was shaped into a head-and-shoulders bullish reversal formation. It helps it bypass multiple key levels. However, the neckline of the structure lies at 0.98360, and the market has not been able to convincingly steer clear of the level.

After breaching the level on the 24th of October, the bears slipped into the market to make a double-top pattern above the level, which then plunged the currency pair back below 0.98360. A new attempt to rise above the level hasn’t gone well, and the EURCHF is back below the key level. The MA period 50 (Moving Average) is still below the candlesticks and may push up the price when they meet.

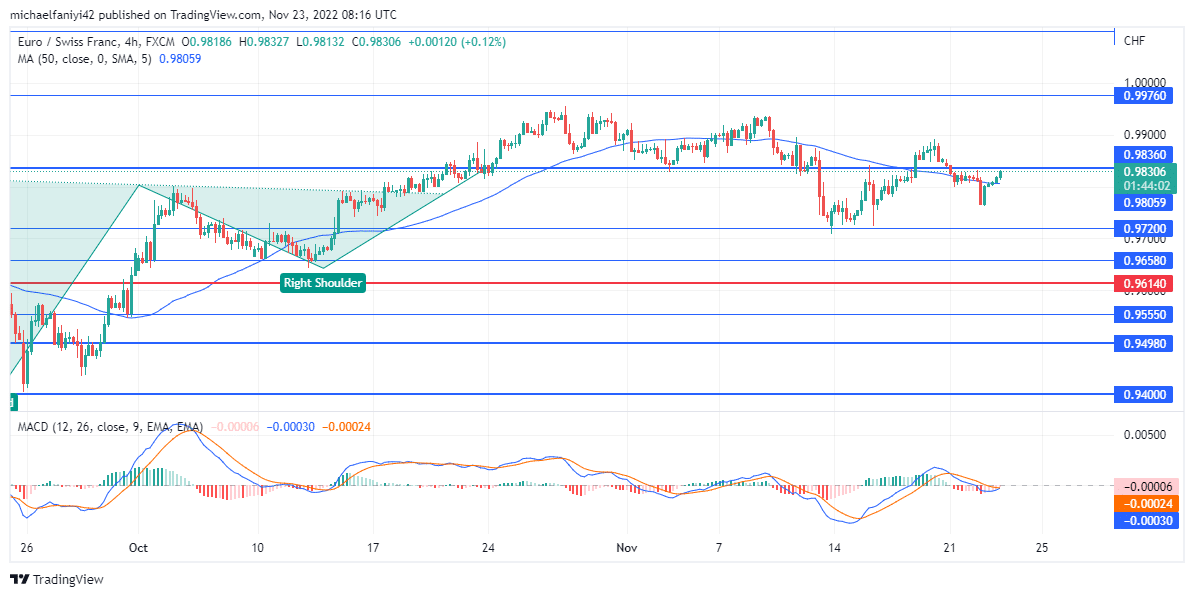

EURCHF Short-Term Trend: Bearish

Also on the daily chart, the MACD (moving average convergence divergence) lines remain positive but are approaching the midpoint (it is already at the midpoint on the 4-hours chart). The lines are accompanied by long bearish histogram bars. This shows that even though the bears are currently driving, the buyers have not lost the market and can regain it to continue their upward course.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.