Market Analysis – October 29

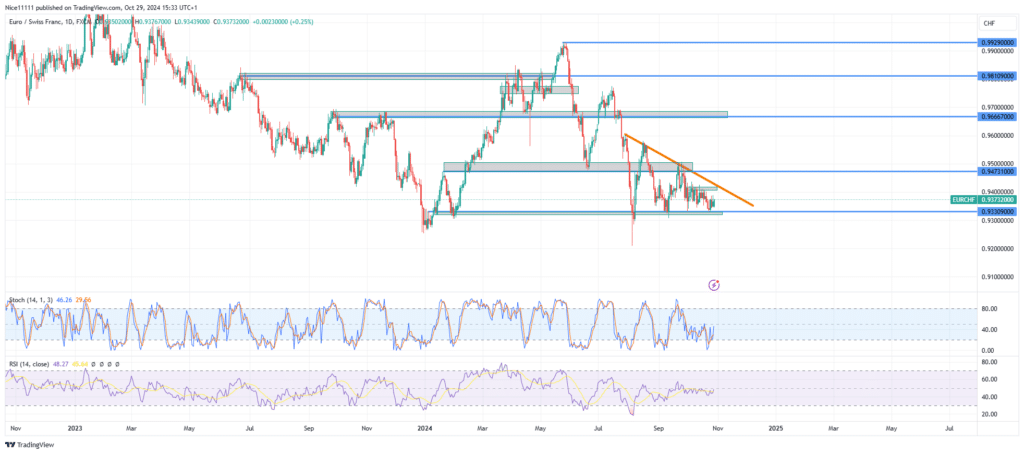

EURCHF experienced a bearish market shift following the break below the bullish order block at 0.9769 in June. This shift led to a series of lower highs, gradually driving the market down to the demand zone at 0.9330.

EURCHF Key Levels

Demand Levels: 0.93310, 0.90000

Resistance Levels: 0.94730, 0.96670

EURCHF Long-Term Trend: Bearish

Since the reversal at 0.9929 in May, EURCHF has maintained a bearish structure. Upon reaching the demand level of 0.9330 in August, a prominent shadow formed below this level, indicating a rejection of lower prices and signalling strong buyer support.

Despite continued lower highs, the market has held above the 0.9330 support, resulting in a descending triangle formation on the daily chart. The support level has been tested four times without breaking, demonstrating active defence by buyers in this zone.

EURCHF Short-Term Trend: Ranging

EURCHF Short-Term Trend: Ranging

On the lower timeframes, the market shows consolidation around the 0.9330 support level, reflecting the strength of this demand zone. This prolonged sideways movement, coupled with the descending triangle on the higher timeframe, suggests that a breakout is imminent. A decisive move beyond this pattern may set the direction for the next volatile phase in EURCHF and help determine bias for accurate forex signals.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.

EURCHF Short-Term Trend: Ranging

EURCHF Short-Term Trend: Ranging