Market Analysis – February 14

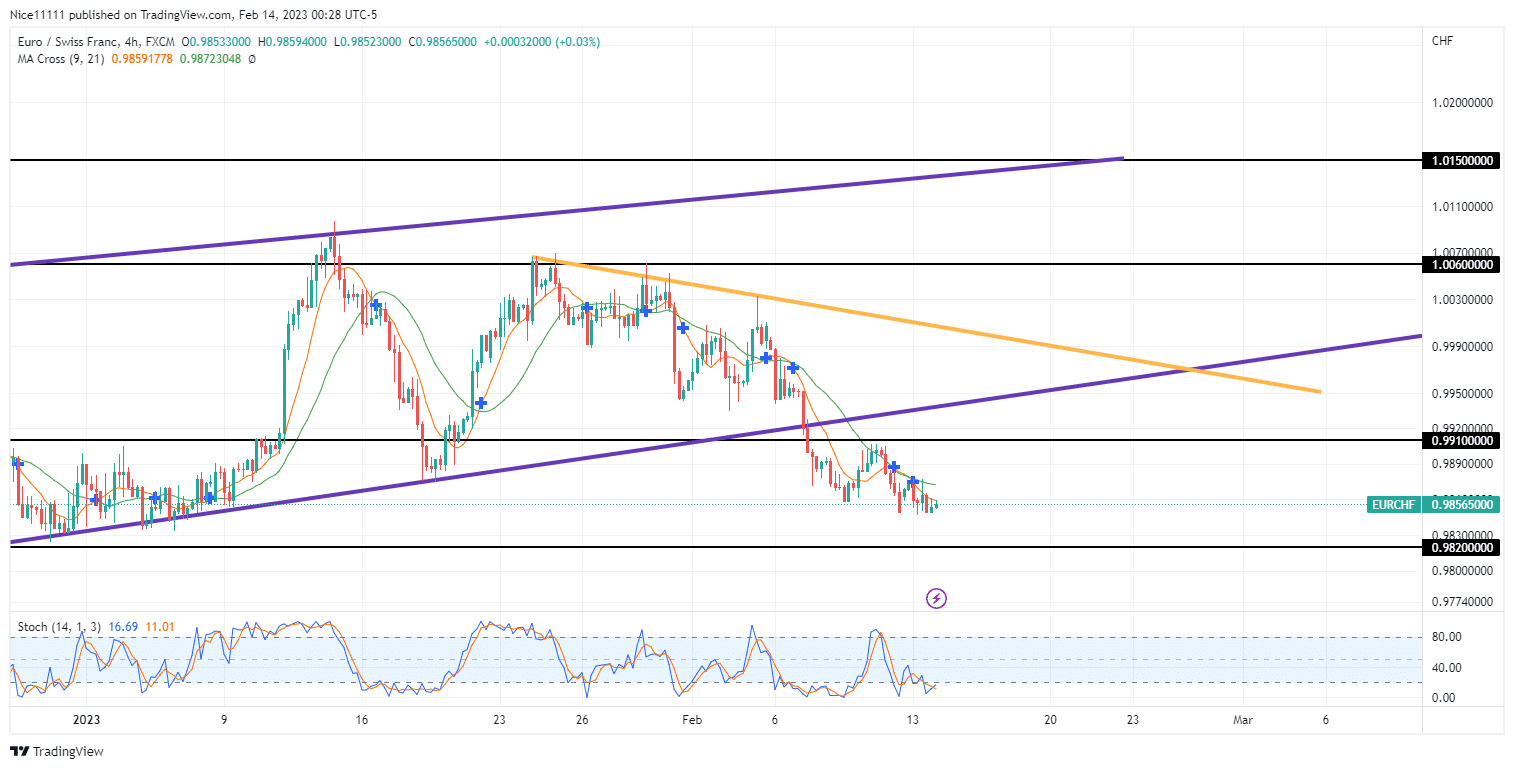

EURCHF’s price action has revealed a clear sign of a descending trend. The supporting trend line of the ascending wedge has failed to support the price.

EURCHF Key Levels

Demand Levels: 0.9820, 0.9720, 0.9430

Supply Levels: 0.9910, 1.0600, 1.0150

EURCHF Long-term trend: Bearish

In the third quarter of the previous year, the EURCHF market experienced a downward spiral. The price plummeted without gaining support for almost three months. The first attempt to rally in August failed. The Moving Average period nine swerved above the Moving Average period twenty-one but plunged immediately. Three white soldiers eventually led the buyers out of the oversold region in October.

The market has ascended through a rising wedge. The contention between the buyers and sellers was tough at the end of the previous year. The month of December moved sideways to form a range between 0.9910 and 0.9820. The buyers utilized their last energy to break out of the range. The market surged up to $1.060.0.

EURCHF Short-term trend: Bearish

The lower border of the bullish wedge gave way to the sell-off from 1.0060. The retest on 0.9910 is expected to cause a further decline in the price of EURCHF.

Do you want to take your trading to the next level? Join the best platform for that here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.