Market Analysis – May 30

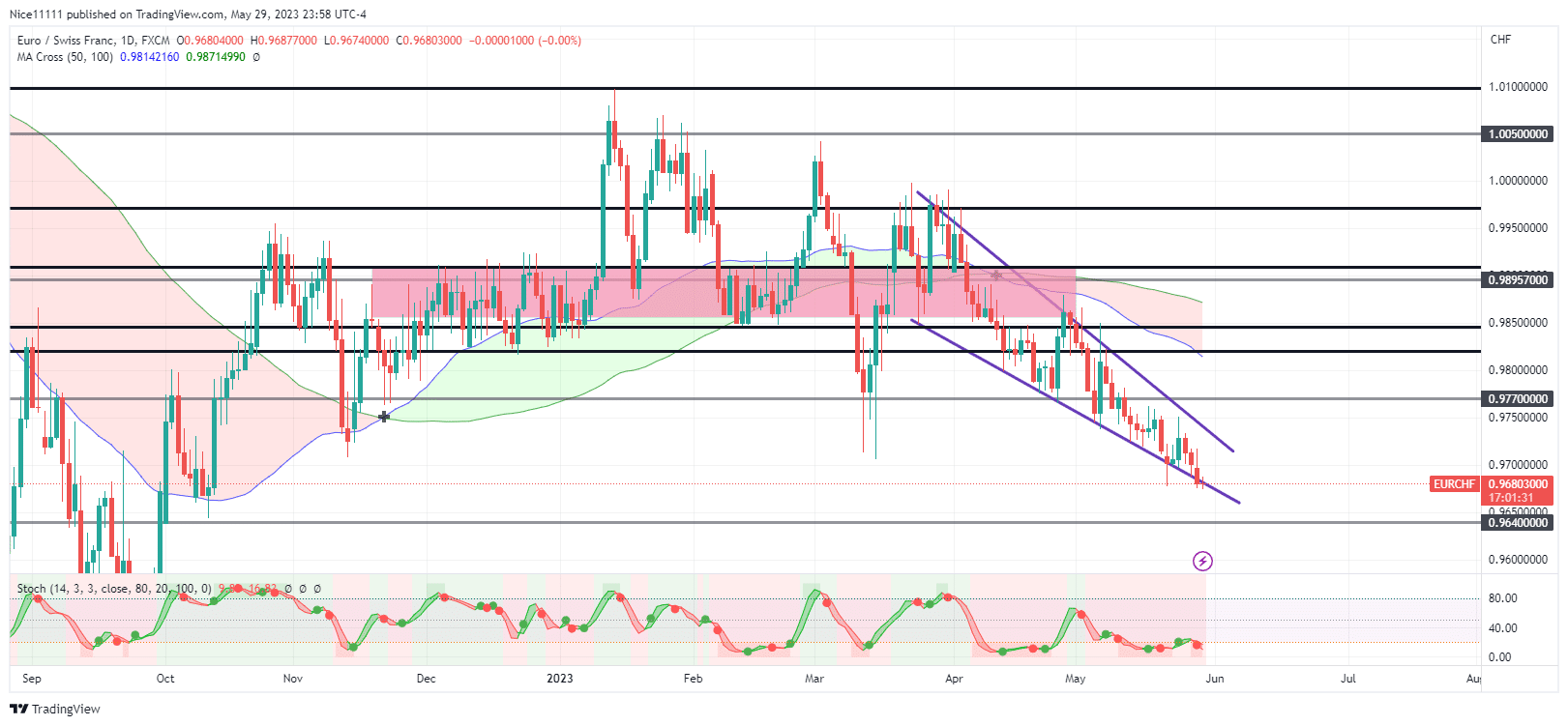

EURCHF is presently embarking on a robust downward trajectory. Notably, there has been substantial price volatility in both directions throughout February and March before establishing the prevailing downtrend. The market exhibited volatile displacements in price, experiencing fluctuations in upward and downward directions before the bearish sentiment took hold. Currently, EURCHF is on a precipitous descent toward the demand level of 0.9640.

EURCHF Key Levels

Demand Levels: 0.9640, 0.9500, 0.9000

Supply Levels: 0.9770, 0.9890, 1.0050

EURCHF Long-term Trend: Bearish

The EURCHF market continues to exhibit a persistent bearish sentiment as sellers firmly assert their dominance. Initially, there was a brief respite in the downward pressure when the bearish order block was breached during a swing in March, creating a momentary bullish outlook. However, this optimistic sentiment was short-lived, as the market quickly succumbed to the formation of a double-top pattern. The subsequent breach of the neckline of this pattern served as a decisive trigger, resulting in an unimpeded descent in price.

Following the test of the 0.9770 demand level, a retracement occurred in April, providing traders with selling opportunities as the market continued its downward trajectory. The Moving Averages (periods 50 and 100) are hovering above the daily candles to signify a bearish trend.

EURCHF Short-term Trend: Bearish

The market structure is clearly defined and characterized by a sequence of lower highs and lows. A notable development is the breach of the 0.9770 demand level, which further reinforces the bearish sentiment. Presently, the price action is being guided by a bearish wedge pattern, which acts as a channel directing the market toward the 0.9640 level. This pattern signifies the prevailing downward momentum and serves as a potential area of support or resistance as the market unfolds.

Overall, the EURCHF market is firmly entrenched in a bearish trend, with sellers exerting control and driving the price toward lower levels.

Do you want to take your trading to the next level? Join the best platform for that here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.