Market Analysis – April 11

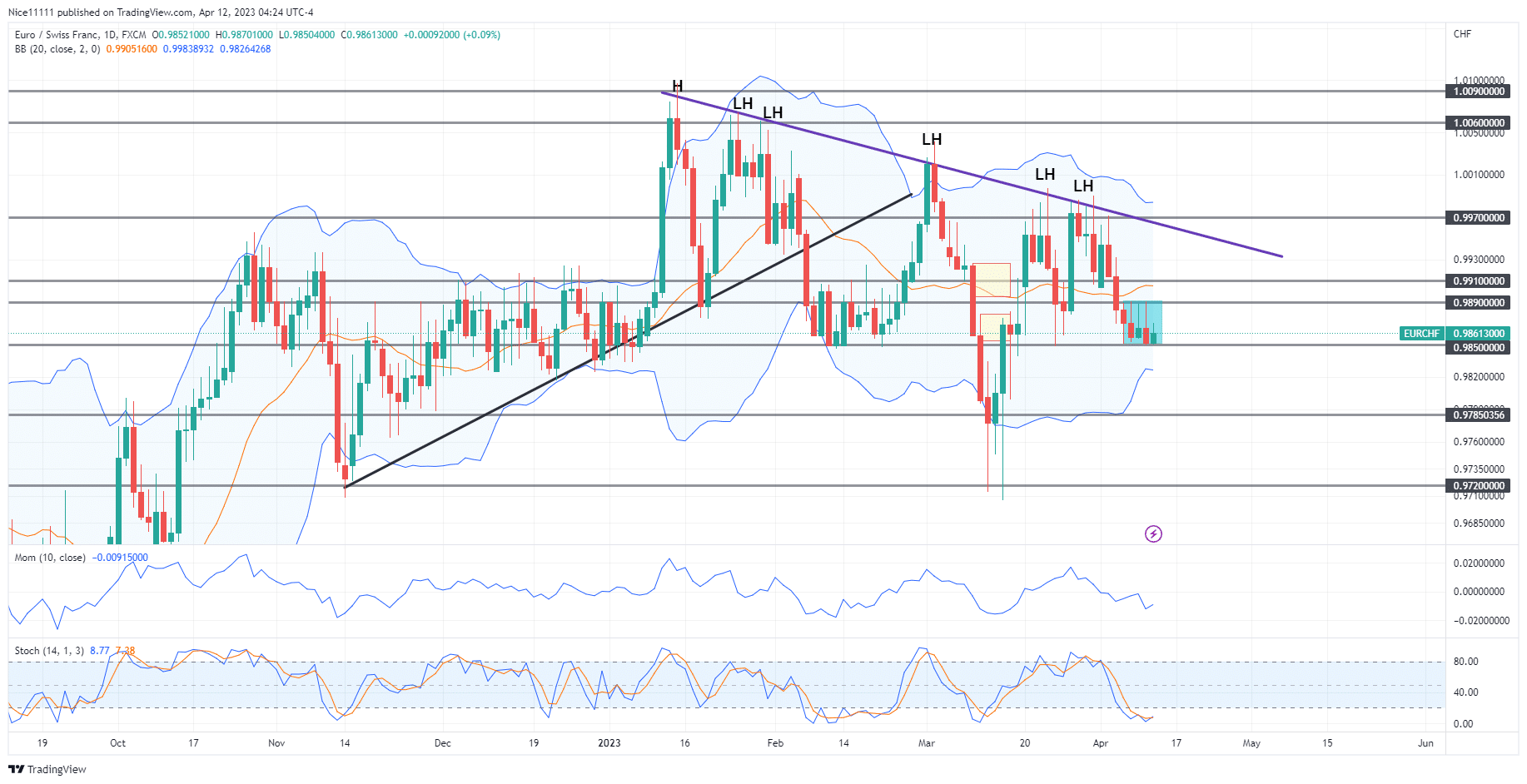

The EURCHF market continues to respect the resistance trendline anchored on the current year’s high at 1.0090. The bearish trendline has successfully prevented an ascent in EURCHF’s market after multiple tests.

EURCHF Key Levels

Resistance Levels: 0.9890, 0.9970, 1.0060

Support Levels: 0.9850, 0.9780, 0.9720

EURCHF Long-term Trend: Bearish

The EURCHF market found support in November after pressing on the lower Bollinger band and the support level of 0.8720. The Stochastic Oscillator indicated the end of the pullback. A price surge from the support level followed. The price rose rapidly to the supply level of 0.9890. Consolidation abounded in December. It was obvious from the momentum indicator that the market had lost momentum to rally. After the test of the supporting band of the Bollinger on the 29th of December, Buyers gained momentum. The market experienced a bullish displacement to 1.0090 in January.

The high of 1.0090 in January has remained the market’s peak this year. The ascending trendline on the daily chart failed to hold on the 7th of February. Subsequent highs have aligned orderly below one another. The swing highs have been anchored perfectly on a bearish trend line.

EURCHF Short-term Trend: Bearish

The Stochastic Oscillator is already oversold on the daily chart as well as the 4-hour chart. A pullback to the bearish trendline is currently anticipated.

Do you want to take your trading to the next level? Join the best platform for that here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.