Market Analysis – August 5

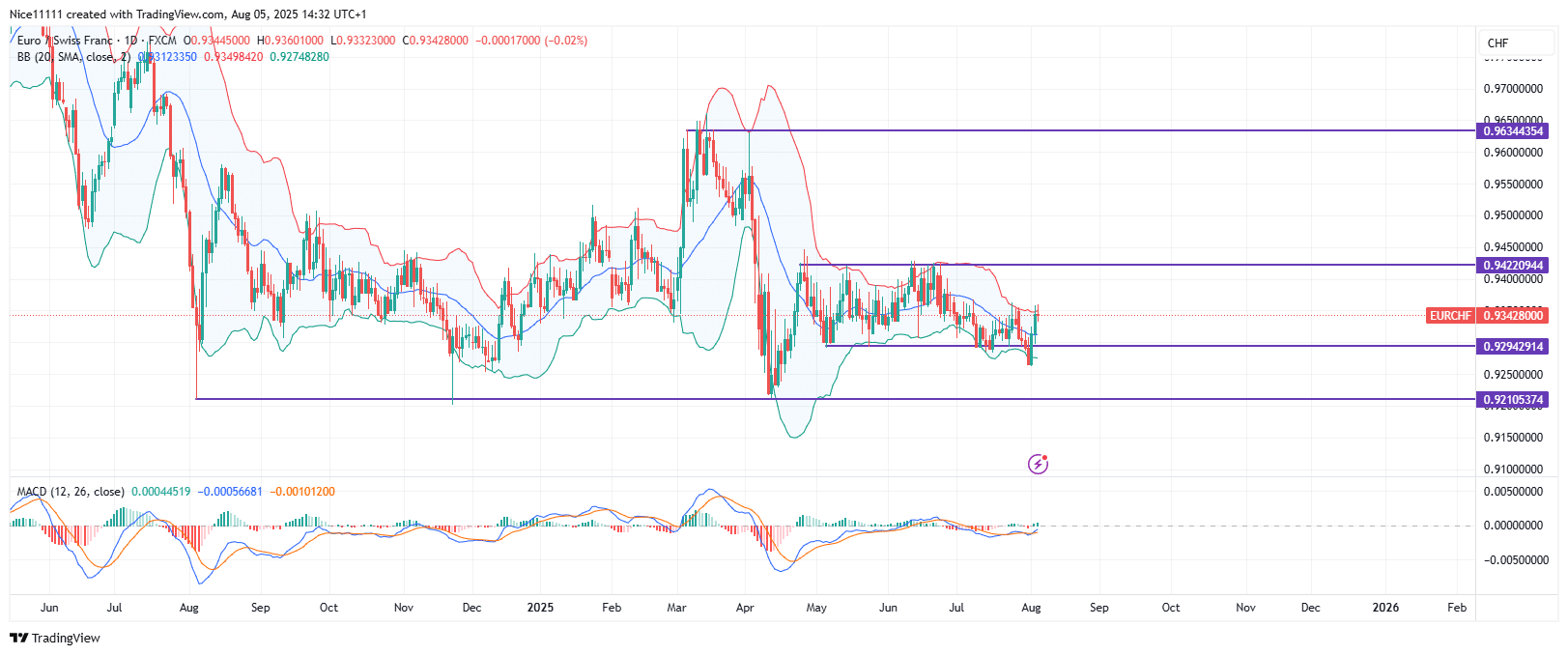

EURCHF has remained confined within a well-defined range between the price levels of 0.94220 and 0.92940 since late April. This prolonged sideways movement has led to the formation of a clear consolidation zone. Recently, the price pushed convincingly below the lower boundary of the range, suggesting a possible bearish breakout, but was swiftly pulled back inside the range, signaling a failed attempt by the bears.

EURCHF Key Levels

Demand Levels: 0.92940, 0.92110

Supply Levels: 0.96340, 0.92100

EURCHF Long-term Trend: Ranging

The prolonged range in EURCHF has created numerous trading opportunities, particularly for scalpers and traders employing mean reversion strategies. Each test of the range boundaries, when supported by additional confirmations, has consistently served as a valid signal to trade in the opposite direction. The reliability of this range is strengthened by at least three confirmed tests at both the upper resistance and lower support levels.

Most recently, EURCHF rebounded from the support zone and began ascending toward the resistance boundary. However, the upward move lost steam, and the price dipped once again—this time falling briefly below the support zone in what appeared to be a breakout attempt. The breakout failed, and a swing high has since formed, placing the price back around the midpoint of the range.

EURCHF Short-term Trend: Bullish

EURCHF Short-term Trend: Bullish

On the lower timeframe, the market has shifted into a bullish structure. A fresh break of structure to the upside confirms a short-term bullish continuation. However, the MACD on the 4-hour chart reveals a rapidly weakening bullish momentum, suggesting caution. A revisit to the immediate bullish order block may provide the needed liquidity and momentum for buyers to regain control. This zone could also offer a favourable entry point for forex signals. Conservative traders often prefer targeting the midrange of consolidation phases rather than aiming for the extremes of the range, especially in uncertain momentum conditions.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.

EURCHF Short-term Trend: Bullish

EURCHF Short-term Trend: Bullish