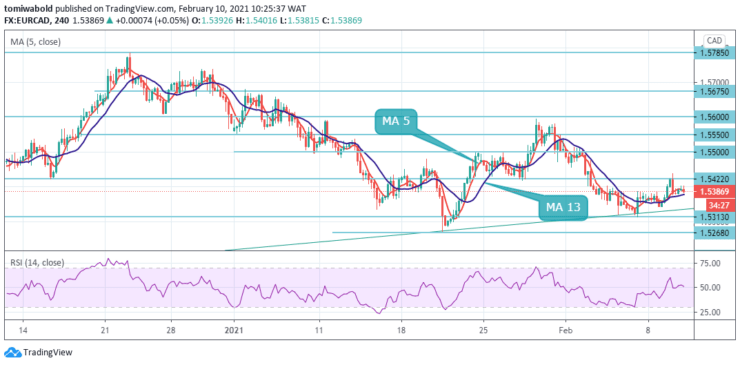

EURCAD Price Analysis – February 10

The EURCAD has been in an impulsive move higher after rebounding past 1.5400 level during the prior day and currently in the present session. The common European currency has surged by 24 pips or 0.15% against the Canadian Dollar since the day began amid the sideways market.

Key Levels

Resistance Levels: 1.5550, 1.5500, 1.5422

Support Levels: 1.5313, 1.5268, 1.5200

The EURCAD’s strong break of the 1.5400 round mark suggests and confirms the resumption of the whole rebound from 1.5313 temporary low regions. Traders should tentatively look for bottoming signals between 1.5268 and 1.5313 to contain recent downside and further the rebound. But decisive break would open up a deep medium term fall to the 1.5200 regions.

Meanwhile, we’d expect a loss of downside momentum as it attempts to flip resistance at 1.5422 level. On the upside, though, a break of the 1.5500 resistance level is needed to confirm completion of the fall. Otherwise, the outlook will stay ranging.

The technical analysis on the 4-hour chart recommends traders should wait for more confirmation that price will stall by watching out for a visible lower low/lower high sequence from the continuous sideways trading above 1.5313 level.

As for the present bias, the near term outlook may remain in a range as long as the 1.5422 resistance level holds. Hence, we’d look for a topping sign around there. Meanwhile, on the downside, a break of 1.5313 minor support levels is needed to indicate the completion of the rebound. Otherwise, a further rise will remain in favor in case of retreat.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.