EURCAD Price Analysis – November 4

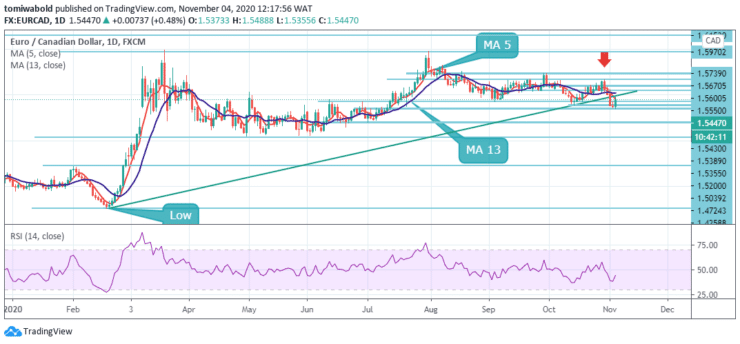

The Eurozone single currency rebounds by 0.50% against the Canadian Dollar since the days start towards 1.5500 marks. The currency pair is looking towards its moving average of 5 on the daily chart. ECB monetary policy decision is a major focus for the Eurozone and may give room for further easing by December.

Key Levels

Resistance Levels: 1.5739, 1.5675, 1.5550

Support levels: 1.5350, 1.5200

Despite trading to lows of 1.5355 level, the EURCAD rebounds towards the 1.5500 marks as technical indicators flash buying signals on the daily time-frame chart. Most likely, bulls are likely to pressure the exchange rate higher within this week’s trading sessions.

However, if the EURCAD pair breaks the prior support cluster at 1.5355, bearish traders could push the currency exchange rate lower towards July 2020 low at 1.5200 in the near term. If the breakout occurs upside, a surge towards the resistance level at 1.5670 level could be expected within this week’s trading sessions.

EURCAD rebounded strongly just at the 1.5355 support and intraday bias is turned neutral first. On the upside, a break of the 1.5550 level will likely resume the corrective pattern from the 1.5039 low with another rise through 1.5739 resistance. On the downside, a break of 1.5389 will bring a retest of 1.5355 temporary low.

That said though, the short-term oscillators reflect a condition of weak directional momentum. The RSI is holding marginally beneath its midline, while the downward-pointing moving average 13 is crossed by moving average 5.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.